How do You Avoid Buying High?

How do you avoid buying stocks at their high? By measuring the intrinsic value of a stock and comparing this value to its current price. Also, measure the current stock market value using the tools we will outline in this article. These tools have warned investors in the past about overvalued stock markets.

Buying stocks high is a common beginner investor mistake. We will look at strategies you can use to value individual stocks and the stock market. Together, these two strategies will help you avoid buying stocks at their highs.

The Buffett Indicator

The Buffett indicator is the ratio of the U.S. stock market valuation and its Gross Domestic Product (GDP). The stock market valuation is the price to buy every company on the stock market. GDP is the amount of money the U.S. as a whole makes every year. As a general rule, if it would take the U.S. two years to buy the stock market, its overvalued.

Be careful when using the Buffett Indicator. In recent years, commentators warn that lower interest rates may distort this ratio.

Volatility Index

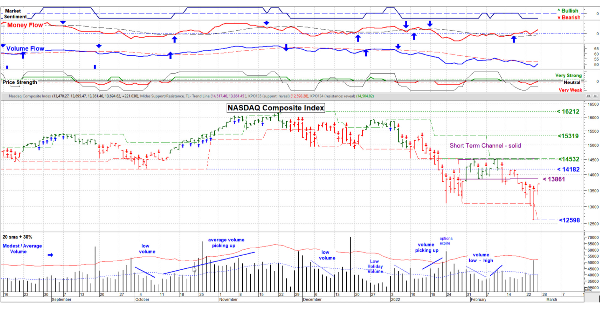

The volatility index measures volatility by measuring the spread of option prices. Options can be insurance against huge swings in the stock market. When investors buy expensive options they are using options as insurance against volatility. The volatility index measures the use of options as insurance.

If the volatility index jumps, market participants are hedging against volatility. This may show the stock market is overvalued.

Measuring the Intrinsic Value of a Stock

Measuring the intrinsic value of a stock determines if its overvalued. For growth stocks, you should replace earnings with cash or revenue. For a typical stock, use earnings to measure intrinsic value.

Protecting Yourself if you do Buy High

Sometimes you can't avoid buying a stock at a top. External factors and black swan events can force a sell-off of your stock even when it was a bargain to buy. Here are some methods you can use to protect yourself if you do buy high.

Use Covered Calls

A covered call is an options strategy to make passive income on stocks you own. To build this strategy, hold the underlying asset and sell a call option for the underlying asset.

Use a cover call when you believe your stock is nearing a high and you want to sell your stock. When you sell a call, you earn a fee for selling that call. By collecting these fees off of a covered call, you can offset your losses if your stock suddenly falls.

Limit Sell

A limit sell is a trading instruction to sell your stock if certain conditions are met. Stocks are sold at market prices when you do not create a limit sell. This means that when you sell, your stock is sold at whatever price the next market participant asks for. In a limit sell, you can tell the brokerage to sell your stock if it hits a certain price.

For example, your stock is trading at $100. When you create a limit sell, you can tell the brokerage to sell your stock for $95. Why? This protects you from a rapid sell-off of your stock, but still let's you hold the stock if it goes up in value. For standard stocks, set a limit sell 10% below the market price. For growth stocks with more volatility, you may want to set the sell price 20% below the market price.

The Bottom Line

Buying stocks at the wrong time happens to all investors. Market randomness and black swan events will happen regardless of your preparation. To minimize the risk of buying high, keep an eye on the total valuation of the market and market volatility. Before buying a stock, calculate its intrinsic value to see if its overvalued. Finally, when you own a stock, use covered calls and limits sells to lower your exposure to market sell-offs.

How do You Avoid Buying High?

How do you avoid buying stocks at their high? By measuring the intrinsic value of a stock and comparing this value to its current price. Also, measure the current stock market value using the tools we will outline in this article. These tools have warned investors in the past about overvalued stock markets.

Buying stocks high is a common beginner investor mistake. We will look at strategies you can use to value individual stocks and the stock market. Together, these two strategies will help you avoid buying stocks at their highs.

The Buffett Indicator

The Buffett indicator is the ratio of the U.S. stock market valuation and its Gross Domestic Product (GDP). The stock market valuation is the price to buy every company on the stock market. GDP is the amount of money the U.S. as a whole makes every year. As a general rule, if it would take the U.S. two years to buy the stock market, its overvalued.

Be careful when using the Buffett Indicator. In recent years, commentators warn that lower interest rates may distort this ratio.

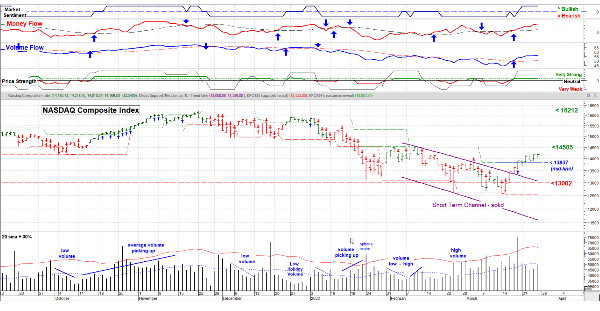

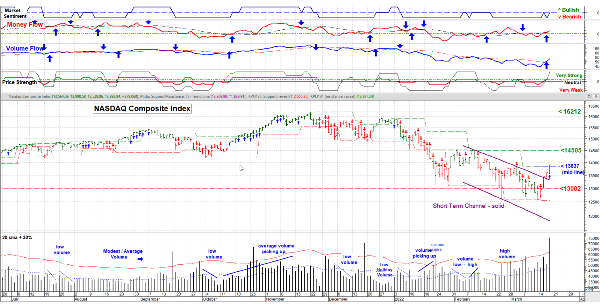

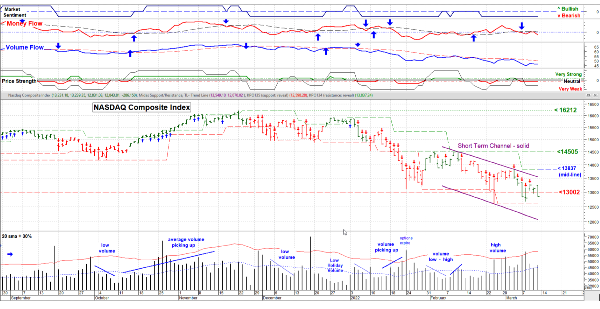

Volatility Index

The volatility index measures volatility by measuring the spread of option prices. Options can be insurance against huge swings in the stock market. When investors buy expensive options they are using options as insurance against volatility. The volatility index measures the use of options as insurance.

If the volatility index jumps, market participants are hedging against volatility. This may show the stock market is overvalued.

Measuring the Intrinsic Value of a Stock

Measuring the intrinsic value of a stock determines if its overvalued. For growth stocks, you should replace earnings with cash or revenue. For a typical stock, use earnings to measure intrinsic value.

Protecting Yourself if you do Buy High

Sometimes you can't avoid buying a stock at a top. External factors and black swan events can force a sell-off of your stock even when it was a bargain to buy. Here are some methods you can use to protect yourself if you do buy high.

Use Covered Calls

A covered call is an options strategy to make passive income on stocks you own. To build this strategy, hold the underlying asset and sell a call option for the underlying asset.

Use a cover call when you believe your stock is nearing a high and you want to sell your stock. When you sell a call, you earn a fee for selling that call. By collecting these fees off of a covered call, you can offset your losses if your stock suddenly falls.

Limit Sell

A limit sell is a trading instruction to sell your stock if certain conditions are met. Stocks are sold at market prices when you do not create a limit sell. This means that when you sell, your stock is sold at whatever price the next market participant asks for. In a limit sell, you can tell the brokerage to sell your stock if it hits a certain price.

For example, your stock is trading at $100. When you create a limit sell, you can tell the brokerage to sell your stock for $95. Why? This protects you from a rapid sell-off of your stock, but still let's you hold the stock if it goes up in value. For standard stocks, set a limit sell 10% below the market price. For growth stocks with more volatility, you may want to set the sell price 20% below the market price.

The Bottom Line

Buying stocks at the wrong time happens to all investors. Market randomness and black swan events will happen regardless of your preparation. To minimize the risk of buying high, keep an eye on the total valuation of the market and market volatility. Before buying a stock, calculate its intrinsic value to see if its overvalued. Finally, when you own a stock, use covered calls and limits sells to lower your exposure to market sell-offs.