Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

June 10, 2022 – At the beginning of this week it appeared that a bottom might be in and a strong rally was underway, but . . . inflation data came out, retailers were reporting that their inventories were up 30 to 40%, consumer confidence continued to be low and *(of course) *gas prices crept even higher. That was it, two days of big drops. I was thinking that we were in-line for a pullback because of the low volume (a.k.a. low commitment) at the higher price levels and besides, nothing has materially changed either.

So what’s next? I’m thinking lower prices early in the week, then a recovery. The strength of that recovery will be telling. But since the FED is meeting next week, and will put out a news release on Wednesday afternoon, not much will happen until late in the week. The market is expecting two more (at least) ½% increases this year. How Powell phrases ANY activity after the meeting will be an important factor on how the market reacts with anticipation. Does he sound dovish or hawkish and to what degree, that is the question. Then we need to evaluate how the market reacts and just how committed it appears. Is volume increasing? Is everything being affected or only a handful of sectors? The bottom line is: Is this market ready to rally?

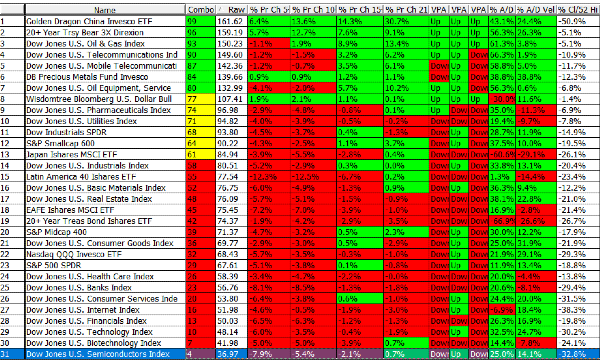

Looking at the Short Term Sector Strength table we see the Energy complex and China showing the most strength. I’ve added a small China position to my Energy & general commodities holdings but still have Cash to deploy IF & When that’s appropriate. And when it’s time to take a position, scale into it. Nobody gives you “extra points” for jumping in with both feet. Have a good week. …………… Tom ………….

Price chart by MetaStock; & table by www.HighGrowthStock.com. Used with permission.

I/we have a position in an asset mentioned