July 1, 2022 – OK folks . . . a little play on words 4th of July style but my feeling is that we’re getting close to stabilizing the selling in this market. Heck, if you’re not ‘out’ it’s just a tad late to be think ‘bout it now. That said I’m seeing signs of capitulation or at least slowing of the selling in here. That’s the first step in building a base so that the market can have a chance to go higher over the long run. The old saying: “When everyone that’s going to sell, sells, the market will (recover and) go higher.” So when everyone that wants out, gets out, the next step is building and stabilizing for the next run.

The big question is whether and base building is just that or only a pause before another round of selling. And that, no one knows the answer right now. IF we’ve hit an economic bottom then the answer is basing and up. If things continue to deteriorate further then the answer is no, we’ve got some problems ahead. Buyers will come in if they see value / growth potential ahead and a glimmer of light at the end of the tunnel. We’re not there yet, but let’s take it a step at a time . . . first building a base.

This all depends on the FED and interest rates (we’re expecting 2 more increases this year at least), how the consumer reacts and to some extent the war in Ukraine / oil / food prices. All of these are important to the economy and hence the stock market. But one should not wait for the economy to lead. By then it’s too late because the stock market will already be ahead of the economy.

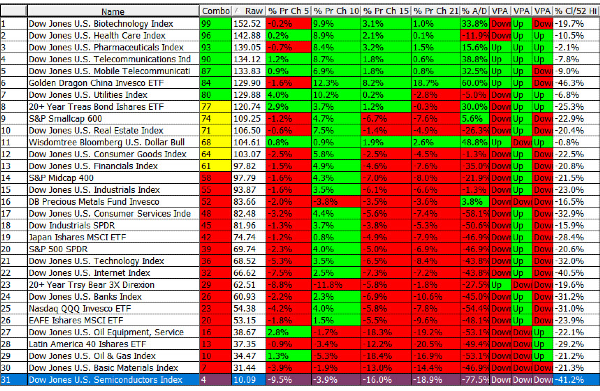

The Short Term Sector table is attached.

The fact that we’re seeing some early signs of strength in other than 100% defensive sectors and Energy falling down is encouraging. It’s early to be excessively Bullish, just hopeful and watchful for now. Make no mistake, all of my trend indicators show a Bear market currently, but some have soften over the past week.

Have a good week & Happy Independence Day for those in the USA. ……… Tom ……….

Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.

July 1, 2022 – OK folks . . . a little play on words 4th of July style but my feeling is that we’re getting close to stabilizing the selling in this market. Heck, if you’re not ‘out’ it’s just a tad late to be think ‘bout it now. That said I’m seeing signs of capitulation or at least slowing of the selling in here. That’s the first step in building a base so that the market can have a chance to go higher over the long run. The old saying: “When everyone that’s going to sell, sells, the market will (recover and) go higher.” So when everyone that wants out, gets out, the next step is building and stabilizing for the next run.

The big question is whether and base building is just that or only a pause before another round of selling. And that, no one knows the answer right now. IF we’ve hit an economic bottom then the answer is basing and up. If things continue to deteriorate further then the answer is no, we’ve got some problems ahead. Buyers will come in if they see value / growth potential ahead and a glimmer of light at the end of the tunnel. We’re not there yet, but let’s take it a step at a time . . . first building a base.

This all depends on the FED and interest rates (we’re expecting 2 more increases this year at least), how the consumer reacts and to some extent the war in Ukraine / oil / food prices. All of these are important to the economy and hence the stock market. But one should not wait for the economy to lead. By then it’s too late because the stock market will already be ahead of the economy. The Short Term Sector table is attached.

The fact that we’re seeing some early signs of strength in other than 100% defensive sectors and Energy falling down is encouraging. It’s early to be excessively Bullish, just hopeful and watchful for now. Make no mistake, all of my trend indicators show a Bear market currently, but some have soften over the past week.

Have a good week & Happy Independence Day for those in the USA. ……… Tom ……….

Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.