Written by Josh Arnold for Sure Dividend

When it comes to finding ways to compound wealth over time, we believe the best way is to buy high-quality dividend stocks, reinvest dividends, and hold them for the long-term. This strategy has been proven to beat the broader market over time, provided the stocks selected can withstand threats from competition and economic recessions.

When searching for high-quality dividend stocks, there are few better places to start than the Dividend Aristocrats. In this article, we’ll take a look at why the Dividend Aristocrats are appealing for dividend investors, as well as three examples of stocks we find attractive today for long-term dividend growth investors.

Why Dividend Aristrocrats?

Let’s begin with why investors should consider the Dividend Aristocrats, as the group is quite a small sliver of the thousands of stocks available in the market today. In order to make the list, a company must be a part of the S&P 500 index, meaning the Dividend Aristocrats are all of meaningful size. In addition, dividends per share must have been increased for a minimum of 25 consecutive years.

Because of these criteria, only the best, most stable dividend growth stocks are in the list, because inferior companies cannot stand the test of time that is required to be a Dividend Aristocrat. What we’re left with is 65 of the best dividend stocks in the market.

The Dividend Aristocrats as a group have lower stock price volatility than the S&P 500 Index because their earnings are generally stable, and industry concentrations tend to be in areas with lower earnings and price volatility, such as consumer staples and industrials. That means drawdowns during weak periods tend to be smaller.

The Dividend Aristocrats also have durable competitive advantages and generate sufficient free cash flow over time to pay and raise their dividends. That means that when recessions do strike, the Dividend Aristocrats tend to come out stronger because weaker competitors may or may not survive.

All of these factors combine to make the group highly attractive for dividend growth investors, so let’s now take a look at three names we like today that offer strong total return prospects to shareholders.

Stanley Black & Decker (SWK)

Our first stock is Stanley Black & Decker, the popular maker of tools and storage equipment that operates globally. The company offers an array of thousands of hand tools, power tools, pneumatic equipment, fasteners, lawn and garden equipment, storage products, industrial tools, and more. The company was founded in 1843, generates about $19 billion in annual revenue, and trades with a market capitalization of $19 billion.

Stanley Black & Decker has managed to increase its dividend for a staggering 54 consecutive years, more than double the requirement to be a Dividend Aristocrat. It has managed to produce a strong combination of organic growth over time, as well as bolt-on acquisitions that have expanded the portfolio. Margins remain strong as well, and the management team is willing and able to return higher amounts of cash to shareholders year after year.

The average dividend increase for Stanley Black & Decker is just under 6% for the past decade, and the payout ratio is just above 30% for this year. Further, we expect 8% annual earnings-per-share growth in the years to come, the combination of which should provide plenty of dividend safety, and room for future increases to shareholders.

Our next stock is Lowe’s Companies, one of the two members of the duopoly that dominate the home improvement segment in the US. Lowe’s operates about 2,000 stores across the US, helping it to distribute tens of thousands of products to property owners, professionals, and commercial customers.

Lowe’s was founded in 1921 with a single hardware store in North Carolina, and since that time, has grown to nearly $100 billion in annual revenue and a market capitalization of $130 billion.

Lowe’s has boosted its dividend for the past 59 years, so its history on dividend longevity is also exemplary. Lowe’s has seen very strong organic revenue growth for many years, which has helped it continue to boost the dividend over time. Its free cash flow generation is excellent, and it has minimal capital expenditure requirements, meaning substantially all free cash flow can be returned to shareholders.

The average dividend increase in the past decade is close to 18%, so Lowe’s is a tremendous dividend growth stock. We also expect 6% earnings-per-share growth annually going forward, and combined with the fact that the current payout ratio is just one-quarter of earnings, there should be plenty of increases for many years to come.

Our final stock is 3M Company, a diversified technology and consumer products company that operates globally. 3M has four segments that serve different customer bases: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer. 3M manufactures and sells thousands of products through these segments, generating $36 billion in annual revenue. The company, which was founded in 1902, trades with a market value of $87 billion.

MMM has one of the longest dividend increase streaks of any company in the market at 64 years. Its reliable, steady revenue growth and stable margin profile means 3M generates strong cash flow each year. In addition to that, it has minimal investment needs, so most of the cash it generates is available to distribute to shareholders.

Despite its consumer staple nature, 3M’s average dividend increase in the past decade is nearly 10%. Like the others in this list, it is a very strong dividend growth stock, in addition to its current yield at 4.1%. We see earnings growth at 5% annually in the coming years, and the payout is right at half of earnings, so 3M scores highly for dividend safety and a runway for future increases.

Final Thoughts

We see the Dividend Aristocrats as the best of the best when it comes to dividend investing, and the recent market swoon has presented strong opportunities in many of the names. For long-term dividend growth investors, we like Stanley Black & Decker, Lowe’s, and 3M for their combinations of safe payouts, dividend growth track records, and payout safety that should withstand competitive threats and recessions in the years to come.

Written by Josh Arnold for Sure Dividend

When it comes to finding ways to compound wealth over time, we believe the best way is to buy high-quality dividend stocks, reinvest dividends, and hold them for the long-term. This strategy has been proven to beat the broader market over time, provided the stocks selected can withstand threats from competition and economic recessions.

When searching for high-quality dividend stocks, there are few better places to start than the Dividend Aristocrats. In this article, we’ll take a look at why the Dividend Aristocrats are appealing for dividend investors, as well as three examples of stocks we find attractive today for long-term dividend growth investors.

Why Dividend Aristrocrats?

Let’s begin with why investors should consider the Dividend Aristocrats, as the group is quite a small sliver of the thousands of stocks available in the market today. In order to make the list, a company must be a part of the S&P 500 index, meaning the Dividend Aristocrats are all of meaningful size. In addition, dividends per share must have been increased for a minimum of 25 consecutive years.

Because of these criteria, only the best, most stable dividend growth stocks are in the list, because inferior companies cannot stand the test of time that is required to be a Dividend Aristocrat. What we’re left with is 65 of the best dividend stocks in the market.

The Dividend Aristocrats as a group have lower stock price volatility than the S&P 500 Index because their earnings are generally stable, and industry concentrations tend to be in areas with lower earnings and price volatility, such as consumer staples and industrials. That means drawdowns during weak periods tend to be smaller.

The Dividend Aristocrats also have durable competitive advantages and generate sufficient free cash flow over time to pay and raise their dividends. That means that when recessions do strike, the Dividend Aristocrats tend to come out stronger because weaker competitors may or may not survive.

All of these factors combine to make the group highly attractive for dividend growth investors, so let’s now take a look at three names we like today that offer strong total return prospects to shareholders.

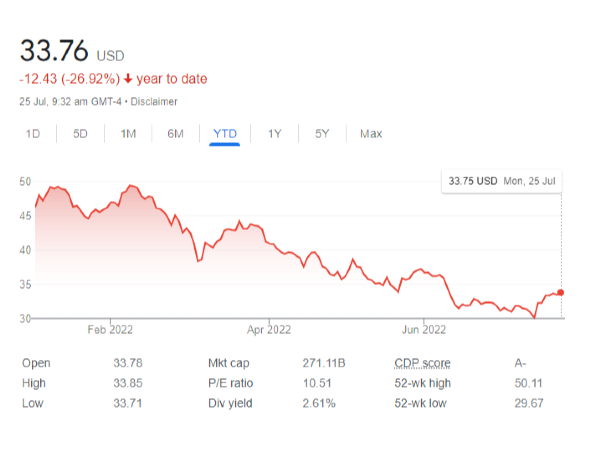

Stanley Black & Decker (SWK)

Our first stock is Stanley Black & Decker, the popular maker of tools and storage equipment that operates globally. The company offers an array of thousands of hand tools, power tools, pneumatic equipment, fasteners, lawn and garden equipment, storage products, industrial tools, and more. The company was founded in 1843, generates about $19 billion in annual revenue, and trades with a market capitalization of $19 billion.

Stanley Black & Decker has managed to increase its dividend for a staggering 54 consecutive years, more than double the requirement to be a Dividend Aristocrat. It has managed to produce a strong combination of organic growth over time, as well as bolt-on acquisitions that have expanded the portfolio. Margins remain strong as well, and the management team is willing and able to return higher amounts of cash to shareholders year after year.

The average dividend increase for Stanley Black & Decker is just under 6% for the past decade, and the payout ratio is just above 30% for this year. Further, we expect 8% annual earnings-per-share growth in the years to come, the combination of which should provide plenty of dividend safety, and room for future increases to shareholders.

Lowe’s Companies (LOW)

Our next stock is Lowe’s Companies, one of the two members of the duopoly that dominate the home improvement segment in the US. Lowe’s operates about 2,000 stores across the US, helping it to distribute tens of thousands of products to property owners, professionals, and commercial customers.

Lowe’s was founded in 1921 with a single hardware store in North Carolina, and since that time, has grown to nearly $100 billion in annual revenue and a market capitalization of $130 billion.

Lowe’s has boosted its dividend for the past 59 years, so its history on dividend longevity is also exemplary. Lowe’s has seen very strong organic revenue growth for many years, which has helped it continue to boost the dividend over time. Its free cash flow generation is excellent, and it has minimal capital expenditure requirements, meaning substantially all free cash flow can be returned to shareholders.

The average dividend increase in the past decade is close to 18%, so Lowe’s is a tremendous dividend growth stock. We also expect 6% earnings-per-share growth annually going forward, and combined with the fact that the current payout ratio is just one-quarter of earnings, there should be plenty of increases for many years to come.

3M Company (MMM)

Our final stock is 3M Company, a diversified technology and consumer products company that operates globally. 3M has four segments that serve different customer bases: Safety and Industrial, Transportation and Electronics, Health Care, and Consumer. 3M manufactures and sells thousands of products through these segments, generating $36 billion in annual revenue. The company, which was founded in 1902, trades with a market value of $87 billion.

MMM has one of the longest dividend increase streaks of any company in the market at 64 years. Its reliable, steady revenue growth and stable margin profile means 3M generates strong cash flow each year. In addition to that, it has minimal investment needs, so most of the cash it generates is available to distribute to shareholders.

Despite its consumer staple nature, 3M’s average dividend increase in the past decade is nearly 10%. Like the others in this list, it is a very strong dividend growth stock, in addition to its current yield at 4.1%. We see earnings growth at 5% annually in the coming years, and the payout is right at half of earnings, so 3M scores highly for dividend safety and a runway for future increases.

Final Thoughts

We see the Dividend Aristocrats as the best of the best when it comes to dividend investing, and the recent market swoon has presented strong opportunities in many of the names. For long-term dividend growth investors, we like Stanley Black & Decker, Lowe’s, and 3M for their combinations of safe payouts, dividend growth track records, and payout safety that should withstand competitive threats and recessions in the years to come.

Originally Posted on simplyinvesting.com