Overview: Anxiety is running high. Rather than ease its Covid restrictions, a surge in cases is seeing more areas in China come under restrictions. The US reports CPI and of the ten reports this year, seven of them have been stronger than expected. The turmoil in the crypto space has gotten noticed even by those not involved. Asia Pacific bourses fell, led by Hong Kong, and Europe’s Stoxx 600 is off for a second day. US equity futures are slightly firmer. US and European 10-year benchmark yields are 2-3 basis points higher. That puts the US Treasury yield near 4.11%. The US dollar is trading higher against all the major currencies but sterling. Emerging market currencies are also weakening against the dollar. Gold is little changed as it hovers above $1700. Demand concerns and a stronger than expected rise in US inventories have extended the retreat in December WTI. It is off for the fourth consecutive session and near $85 it is at its lowest level in more than two weeks. US natgas is heavy after losing 11.6% on Tuesday and nearly 4.5% yesterday. Europe’s natgas benchmark is recouping half of yesterday’s 5.5% decline. Concerns about the impact of the surge in China’s Covid cases has ended the seven-day rally in iron ore prices. December copper is off 1.6% after bouncing about 2.6% over the past two sessions. The USDA lifted its global wheat consumption estimates yesterday and this may be helping steady December wheat after declining nearly 5% in the first three sessions this week.

Asia Pacific

At the end of last week, the buzz was about China moving away from its zero-Covid policy. Today, some of the risk-off activity is being linked to new Covid restrictions in some of China's largest cities. Guangzhou, a large manufacturing center has the most significant outbreak. Some fear that it will be locked down like Shanghai was for a couple of months earlier this year. Chongqing, a megacity, has seen the number of cases jump from single digit at the start of November to over 750 yesterday. Schools and non-essential businesses in some districts are closed. Beijing's cases are the highest in five months, and reports suggests cases are being found outside of the quarantine, which means the virus is still spreading. The lockdown in Zhengzhou has ended in general, the district that houses the largest iPhone factory will continue to face strict curbs.

Japan's preliminary October machine tool orders tumbled 5.4% year-over-year, the first decline in two years. Despite a recovery in the world's third-largest economy, the slide in domestic orders accelerated. They are 11.4% below a year-ago after an 8.9% fall in September. China South Korea, and Taiwan all reported a decline a in October exports. Consistent with these signals of weaker global demand, Japan reported the first contraction in foreign machine orders since October 2020. Separately, there do not seem much to make of the meeting between Japan's Prime Minister Kishida and Bank of Japan Governor Kuroda. The warning about "recent one-sided and rapid weakening of the yen" seems scripted as the dollar tested the lower end of its range near JPY145 yesterday.

The dollar has been confined mostly to a half of a yen range today between JPY146 and JPY146.50. It settled North America yesterday slightly below JPY146.50. The exchange rate may be sensitive to the US CPI and the response of the rates market. Note that there are options for $1.3 bln at JPY147 that expire today. The Australian dollar peaked Tuesday near $0.6550 and today slipped below $0.6400. A break of the $0.6375-80 area could warn of another cent decline. That said, it may take a move above $0.6440 to stabilize the tone. The greenback set a new high for the week against the Chinese yuan near CNY7.2730 but is still confined to the broad range seen at the end of last week (~CNY7.1785-CNY7.3120). The PBOC set the dollar's reference rate at CNY7.2422 compared with the median in Bloomberg's survey of CNY7.2517. Meanwhile, the yuan fell to its lowest level against its trade weighted basket (CFETS) since October 2021.

Europe

Some narratives attributed the sharp sell-off in the euro yesterday to the ECB's consumer Expectations Survey. The median expectation edged up to 5.1% from 5.0% for the 12-month outlook. Expectations for inflation in three years was steady at 3.0%. However, if that were the driver, it is not clear why the two-year German note yield would fall by 11 bp to halt a six-day rise. The German three-year breakeven followed a similar pattern. After rising nearly 20 bp in the previous six sessions, it fell by eight basis points yesterday to a four-day low (2.79%).

Paris and London often seem like bickering siblings, but they have one common frustration today: public transportation workers are on strike today. In Paris, five of 16 metro lines will not be operable and disruptions on other lines are possible. Negotiations in London failed, and workers on the Underground, are on strike today, and into possibly Friday morning. Nurses in England, Wales, and Scotland voted to strike though specific date has not been set. The strike authority has been granted through next April. The dispute is over patient safety concerns and wage increases of 5% above inflation. A Bloomberg report cited research by London Economics that showed experienced nurses had a 20% decline in real income over the last decade, which is like working one day a week for free compared with ten years ago. The poor pay may exacerbate the shortage of essential workers. In July, the government offered a package that would increase the average nurse's wages by 4%. It is possible that other NHS unions, including midwives and physiotherapist join in coordinated action. Junior doctors will reportedly hold a strike vote in early January.

The UK budget statement next week is going to find many critics. Prime Minister Sunak's personnel choices have already come back to bite with one minister already stepping down. One area that Sunak can make rapid improvement is with the controversial Northern Ireland Protocol. Sunak meets with Ireland's Taoiseach Martin today and will be the first UK PM to attend the opening of the British-Irish Council since 2007. There is some optimism, including in Brussels, that a deal can be reached by the end of the year. One of the implications is that it could delay new elections in Northern Ireland until that deal is struck. The election was postponed until December 8, with a backup date of January 19, looking more likely.

We had thought that the speculation of Chinese jettisoning its zero-Covid policy ran contrary to what we heard from the 20th Party Congress and that when it was recognized last week's moves would reverse somewhat, including the euro. However, the euro continued to advance and traded to almost $1.01. It returned to last week's settlement levels near $0.9960 in Asia today and continued lower to around $0.9935 in the European morning. The next chart support is seen in the $0.9870-$0.9910 area. Note that there are options for 1.33 bln euros at $0.9900 that expire today and another 1.67 bln euros in options struck there that expire tomorrow. Moving above parity would help stabilize the tone. For its part, sterling is holding above yesterday's low near $1.1335, and is holding its own against the dollar today. A move above the $1.1420 area could spur another half-cent gain. That said, the sterling bounced off last week's low near $1.1150 and the $1.1320 area is a (61.8%) retracement of those gains.

America

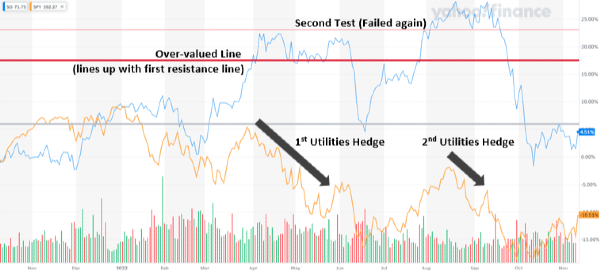

The focus is on the US CPI figures today. The problem is that while the year-over-year rates of headline and core inflation may ease the month-over-month increases (0.5%-0.65) are too high to give the Fed much breathing space. It must be assumed that Fed officials have the same information set as the market does, including the magnitude of tightening of financial conditions and the prospect of rents will slow next year. Research by the San Francisco Federal Reserve finds that Zillow's Observed Rent Index leads CPI rent by 12 months. Zillow's index peak in February (17.2%) and was at 10.8% in September. The rent component of CPI rose by 7.2% year-over-year in September, rising 0.9% that month alone. Housing is 40% of core CPI. The Cleveland Federal Reserve has a CPI Nowcasting tool. It warns of slightly higher than expected headline CPI. It has the October CPI at 8.1% year-over-year, while the median forecast in Bloomberg's survey has it a 7.9%. The nowcasting model has core CPI steady at the cyclical high of 6.6%, while the Bloomberg survey found a median forecast of 6.5%. Moreover, the Cleveland Fed has November CPI tracking 8% at the headline level and 6.6% at the core.

Some economists, including Krugman, are talking about the underlying rate, by which is often meant the prices that are driven by primarily by market forces. The oligopolistic nature of many industries in the US seems to be cast aside. Nevertheless, Krugman recently opined that the underlying rate of inflation may have dropped to as low as 3%. The New York Federal Reserve has an underlying inflation gauge. It includes three main components, prices, real activity, and financial data. The estimate for September was 4.4% and 6% if only prices were included. It is important that market participants keep focused on what the Fed is likely to do and not, what a particular person, even a Nobel-prize winning economist (for contributions to trade theory not monetary policy), wishes the Fed to do. The market heads into the CPI report with about a 30% chance of another 75 bp move in December. Yes, many expect a US recession next year whether it is a 50 bp move or 75 bp. That said, the Atlanta Fed's GDPNow tracker sees Q4 GDP at 4.0%. The prospect for growth to be more than twice what the Fed reckons to be trend (non-inflationary growth) might not sit well with officials.

The other highlight of the North American session is Mexico's central bank meeting. Banxico is expected to hike its overnight target rate 75 bp to 10.00%. The October CPI report yesterday showed a small decline in the headline rate to 8.41% from 8.70% in August and September. It was the first decline since May. The core rate firmed to a new cyclical high of 8.42%. It has not decline since November 2020. Even though the peso is one of the strongest currencies in the world this year (after the Russian rouble and the Brazilian real), central bank officials have wanted to stay in line with Fed moves. The next Banxico meeting after today is December 15, the day after the FOMC meeting. We suspect that there may be a temptation to go 50 bp even if the Fed delivers a 75 bp hike next month.

The pullback in stocks and the broad US dollar's strength yesterday proved too much for the Canadian dollar, which succumbed to the pressure. The greenback moved back above the neckline of the large head and shoulder pattern we have been monitoring at CAD1.3500. It has held above there today. Yesterday's recovery has been extended from around CAD1.3540 to slightly more than CAD1.3560. This meets the (38.2%) retracement of the decline from the November 3 high near CAD1.3810. The next retracement is close to CAD1.3600. The US dollar's downside momentum against the Mexican peso stalled earlier this week ahead of MXN19.43, a bit ahead of the two-year lows set in late May near MXN19.41. It is trading within yesterday's range (~MXN19.51-19.63). A move above MXN19.65 could spur a move toward MXN19.70-75. Brazil reports the IPCA inflation measure today. It is expected to fall for the fourth consecutive month. The median projection in Bloomberg's survey sees it declining to 6.36% from 7.17% in September. It peaked in April at 12.13%. If the median forecast is accurate, it would the slowest inflation since March 2021. It is too early to think about a cut in the Selic rate, which stands at 13.75%.

Overview: Anxiety is running high. Rather than ease its Covid restrictions, a surge in cases is seeing more areas in China come under restrictions. The US reports CPI and of the ten reports this year, seven of them have been stronger than expected. The turmoil in the crypto space has gotten noticed even by those not involved. Asia Pacific bourses fell, led by Hong Kong, and Europe’s Stoxx 600 is off for a second day. US equity futures are slightly firmer. US and European 10-year benchmark yields are 2-3 basis points higher. That puts the US Treasury yield near 4.11%. The US dollar is trading higher against all the major currencies but sterling. Emerging market currencies are also weakening against the dollar. Gold is little changed as it hovers above $1700. Demand concerns and a stronger than expected rise in US inventories have extended the retreat in December WTI. It is off for the fourth consecutive session and near $85 it is at its lowest level in more than two weeks. US natgas is heavy after losing 11.6% on Tuesday and nearly 4.5% yesterday. Europe’s natgas benchmark is recouping half of yesterday’s 5.5% decline. Concerns about the impact of the surge in China’s Covid cases has ended the seven-day rally in iron ore prices. December copper is off 1.6% after bouncing about 2.6% over the past two sessions. The USDA lifted its global wheat consumption estimates yesterday and this may be helping steady December wheat after declining nearly 5% in the first three sessions this week.

Asia Pacific

At the end of last week, the buzz was about China moving away from its zero-Covid policy. Today, some of the risk-off activity is being linked to new Covid restrictions in some of China's largest cities. Guangzhou, a large manufacturing center has the most significant outbreak. Some fear that it will be locked down like Shanghai was for a couple of months earlier this year. Chongqing, a megacity, has seen the number of cases jump from single digit at the start of November to over 750 yesterday. Schools and non-essential businesses in some districts are closed. Beijing's cases are the highest in five months, and reports suggests cases are being found outside of the quarantine, which means the virus is still spreading. The lockdown in Zhengzhou has ended in general, the district that houses the largest iPhone factory will continue to face strict curbs.

Japan's preliminary October machine tool orders tumbled 5.4% year-over-year, the first decline in two years. Despite a recovery in the world's third-largest economy, the slide in domestic orders accelerated. They are 11.4% below a year-ago after an 8.9% fall in September. China South Korea, and Taiwan all reported a decline a in October exports. Consistent with these signals of weaker global demand, Japan reported the first contraction in foreign machine orders since October 2020. Separately, there do not seem much to make of the meeting between Japan's Prime Minister Kishida and Bank of Japan Governor Kuroda. The warning about "recent one-sided and rapid weakening of the yen" seems scripted as the dollar tested the lower end of its range near JPY145 yesterday.

The dollar has been confined mostly to a half of a yen range today between JPY146 and JPY146.50. It settled North America yesterday slightly below JPY146.50. The exchange rate may be sensitive to the US CPI and the response of the rates market. Note that there are options for $1.3 bln at JPY147 that expire today. The Australian dollar peaked Tuesday near $0.6550 and today slipped below $0.6400. A break of the $0.6375-80 area could warn of another cent decline. That said, it may take a move above $0.6440 to stabilize the tone. The greenback set a new high for the week against the Chinese yuan near CNY7.2730 but is still confined to the broad range seen at the end of last week (~CNY7.1785-CNY7.3120). The PBOC set the dollar's reference rate at CNY7.2422 compared with the median in Bloomberg's survey of CNY7.2517. Meanwhile, the yuan fell to its lowest level against its trade weighted basket (CFETS) since October 2021.

Europe

Some narratives attributed the sharp sell-off in the euro yesterday to the ECB's consumer Expectations Survey. The median expectation edged up to 5.1% from 5.0% for the 12-month outlook. Expectations for inflation in three years was steady at 3.0%. However, if that were the driver, it is not clear why the two-year German note yield would fall by 11 bp to halt a six-day rise. The German three-year breakeven followed a similar pattern. After rising nearly 20 bp in the previous six sessions, it fell by eight basis points yesterday to a four-day low (2.79%).

Paris and London often seem like bickering siblings, but they have one common frustration today: public transportation workers are on strike today. In Paris, five of 16 metro lines will not be operable and disruptions on other lines are possible. Negotiations in London failed, and workers on the Underground, are on strike today, and into possibly Friday morning. Nurses in England, Wales, and Scotland voted to strike though specific date has not been set. The strike authority has been granted through next April. The dispute is over patient safety concerns and wage increases of 5% above inflation. A Bloomberg report cited research by London Economics that showed experienced nurses had a 20% decline in real income over the last decade, which is like working one day a week for free compared with ten years ago. The poor pay may exacerbate the shortage of essential workers. In July, the government offered a package that would increase the average nurse's wages by 4%. It is possible that other NHS unions, including midwives and physiotherapist join in coordinated action. Junior doctors will reportedly hold a strike vote in early January.

The UK budget statement next week is going to find many critics. Prime Minister Sunak's personnel choices have already come back to bite with one minister already stepping down. One area that Sunak can make rapid improvement is with the controversial Northern Ireland Protocol. Sunak meets with Ireland's Taoiseach Martin today and will be the first UK PM to attend the opening of the British-Irish Council since 2007. There is some optimism, including in Brussels, that a deal can be reached by the end of the year. One of the implications is that it could delay new elections in Northern Ireland until that deal is struck. The election was postponed until December 8, with a backup date of January 19, looking more likely.

We had thought that the speculation of Chinese jettisoning its zero-Covid policy ran contrary to what we heard from the 20th Party Congress and that when it was recognized last week's moves would reverse somewhat, including the euro. However, the euro continued to advance and traded to almost $1.01. It returned to last week's settlement levels near $0.9960 in Asia today and continued lower to around $0.9935 in the European morning. The next chart support is seen in the $0.9870-$0.9910 area. Note that there are options for 1.33 bln euros at $0.9900 that expire today and another 1.67 bln euros in options struck there that expire tomorrow. Moving above parity would help stabilize the tone. For its part, sterling is holding above yesterday's low near $1.1335, and is holding its own against the dollar today. A move above the $1.1420 area could spur another half-cent gain. That said, the sterling bounced off last week's low near $1.1150 and the $1.1320 area is a (61.8%) retracement of those gains.

America

The focus is on the US CPI figures today. The problem is that while the year-over-year rates of headline and core inflation may ease the month-over-month increases (0.5%-0.65) are too high to give the Fed much breathing space. It must be assumed that Fed officials have the same information set as the market does, including the magnitude of tightening of financial conditions and the prospect of rents will slow next year. Research by the San Francisco Federal Reserve finds that Zillow's Observed Rent Index leads CPI rent by 12 months. Zillow's index peak in February (17.2%) and was at 10.8% in September. The rent component of CPI rose by 7.2% year-over-year in September, rising 0.9% that month alone. Housing is 40% of core CPI. The Cleveland Federal Reserve has a CPI Nowcasting tool. It warns of slightly higher than expected headline CPI. It has the October CPI at 8.1% year-over-year, while the median forecast in Bloomberg's survey has it a 7.9%. The nowcasting model has core CPI steady at the cyclical high of 6.6%, while the Bloomberg survey found a median forecast of 6.5%. Moreover, the Cleveland Fed has November CPI tracking 8% at the headline level and 6.6% at the core.

Some economists, including Krugman, are talking about the underlying rate, by which is often meant the prices that are driven by primarily by market forces. The oligopolistic nature of many industries in the US seems to be cast aside. Nevertheless, Krugman recently opined that the underlying rate of inflation may have dropped to as low as 3%. The New York Federal Reserve has an underlying inflation gauge. It includes three main components, prices, real activity, and financial data. The estimate for September was 4.4% and 6% if only prices were included. It is important that market participants keep focused on what the Fed is likely to do and not, what a particular person, even a Nobel-prize winning economist (for contributions to trade theory not monetary policy), wishes the Fed to do. The market heads into the CPI report with about a 30% chance of another 75 bp move in December. Yes, many expect a US recession next year whether it is a 50 bp move or 75 bp. That said, the Atlanta Fed's GDPNow tracker sees Q4 GDP at 4.0%. The prospect for growth to be more than twice what the Fed reckons to be trend (non-inflationary growth) might not sit well with officials.

The other highlight of the North American session is Mexico's central bank meeting. Banxico is expected to hike its overnight target rate 75 bp to 10.00%. The October CPI report yesterday showed a small decline in the headline rate to 8.41% from 8.70% in August and September. It was the first decline since May. The core rate firmed to a new cyclical high of 8.42%. It has not decline since November 2020. Even though the peso is one of the strongest currencies in the world this year (after the Russian rouble and the Brazilian real), central bank officials have wanted to stay in line with Fed moves. The next Banxico meeting after today is December 15, the day after the FOMC meeting. We suspect that there may be a temptation to go 50 bp even if the Fed delivers a 75 bp hike next month.

The pullback in stocks and the broad US dollar's strength yesterday proved too much for the Canadian dollar, which succumbed to the pressure. The greenback moved back above the neckline of the large head and shoulder pattern we have been monitoring at CAD1.3500. It has held above there today. Yesterday's recovery has been extended from around CAD1.3540 to slightly more than CAD1.3560. This meets the (38.2%) retracement of the decline from the November 3 high near CAD1.3810. The next retracement is close to CAD1.3600. The US dollar's downside momentum against the Mexican peso stalled earlier this week ahead of MXN19.43, a bit ahead of the two-year lows set in late May near MXN19.41. It is trading within yesterday's range (~MXN19.51-19.63). A move above MXN19.65 could spur a move toward MXN19.70-75. Brazil reports the IPCA inflation measure today. It is expected to fall for the fourth consecutive month. The median projection in Bloomberg's survey sees it declining to 6.36% from 7.17% in September. It peaked in April at 12.13%. If the median forecast is accurate, it would the slowest inflation since March 2021. It is too early to think about a cut in the Selic rate, which stands at 13.75%.

Originally Posted on marctomarket.com