Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

October 6, 2023 - First off, I’ve been doing a blog for over 5 years and it may be time to take a rest. My question to readers is: Do you find this useful and of value? If so, please “Add A Comment” and leave me a short response (like “please continue”), other wise since my subscription to Word Press is coming due shortly, I may just take a hiatus and stop for a while. Let me know please.

Well now . . . on Friday we got some very strong jobs data and initially the market dropped for an hour because very good news is “bad”; the FED will raise interest rates and keep them there longer. Then folks settled down and thought that maybe good news means the economy could pull off a “soft landing”; up it went recovering previous losses.

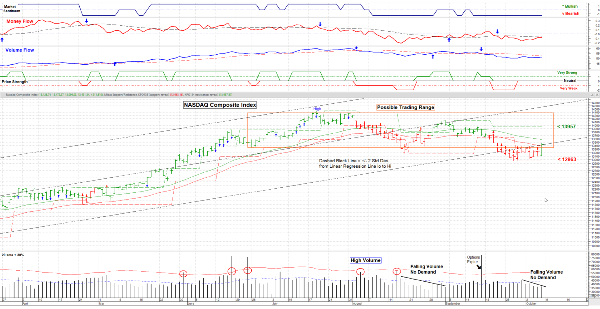

The market has fallen out of the “Trading Range” but made a one-day recovery on Friday. I note the low volume as nobody seems to be 100% convinced that the worst is behind us just yet.

In any case the US indexes did gain a little for the week with the exception of the small cap Russell 2000, which many consider a riskier set of stocks. Next week could be interesting to see how market react to the Palestinian – Israeli conflict and a test of whether this localized swing bottom actually holds. I would not be surprised to see one more push lower before a consolidation range builds into late October for a move back higher by the end of the year. I just feel that this market wants to fake out as many folks as possible before resuming a trend. A quick move down would ‘do it’ before the “smart money” comes back in. Just a theory at this point. The rest of the year should be traditionally positive from mid-October on.

That’s it for now. Please respond to my request to readers and we’ll see what develops. Have a good week. … Tom …