Expertise provided by Darius Smith

Reviewed by Chaster Johnson

When should a beginner buy stocks?

One should start buying/investing in stocks as soon as possible. When it comes to investing in the stock market age does not matter. A student, a youngster, a middle-aged or an old aged person stock market is open for everyone. It is considered to be a very good decision to introduce investment opportunities to students or teenagers at a very early age as this will promote financial literacy and help them understand the basics of the market.

Investing as a student:

A student can start investing in stocks even at a very early stage of third grade or as soon as he/she starts understanding what is a stock. It means one who is at the age of eight years can easily understand and start trading in their stocks.

Investing in the stock market at this early age gives an opportunity to better understand the stock market or we can say it enhances financial literacy.

Best investment for students:

The best investment for students is those stocks that you know well. It means if you have an idea of revenue, fundamentals, p/e ratio, prospects, ,etc of the company then it is the best investment for you. Some of the companies are:

• McDonalds (MCD): It is a well-known fast-food chain. It gives 2.24% dividends to its shareholders.

• General Mills: It is one of the famous staple food producers of America. One can keep this stock in his basket for investment

• Tesla (TSLA): Tesla is a vehicle-producing company. It is the best stock if you are thinking of investing for the long-term as it is a volatile stock.

Investing for beginners with little money:

Investing is a “commitment of money to receive more money later”. Hence, one should start investing in stocks as soon as possible to get a desirable pattern of cash flows in the future. Huge capital is not needed to commence trading; you can always start with little. As Investing has become very affordable these days you can start off with whatever little capital you have with you. Instead of buying an ETF or whole share, you can opt for buying a piece of a share known as a fractional share. Investing in fractional shares benefits the investor in a number of ways, such as:

• It helps in the diversification of your funds as you can buy fractional shares of different companies rather than buying one share of a higher value of one company.

• It helps in reducing your beta i.e. market risk.

• It provides you with a better understanding of the industry as a whole.

• It helps in better portfolio management.

• Leads to wealth generation and growth.

Apart from investing in fractional shares as a beginner you also need to take care of the cost part of your investment. Costs have direct impacts on returns on your investment. The two main components of cost in trading are:

Commission also termed as transaction cost: It is a cost that is incurred in buying and selling securities. Therefore, to eliminate or reduce this cost you need to reduce the frequency of your trade (Avoiding loss of potential profit occurring from "payment of trade flow").

Tax is another important component of cost that can be reduced by holding your investment for a period of more than one year.

Best stocks for beginners:

Fundamentally strong and well-known stocks are always a best choice for beginners to invest in stocks.

Before moving to invest in any particular stock you need to learn how the stock market works for beginners. The diagram below explains the procedure to buy the stock.

Image from: Bing.com

how to buy shares of stock - Search Images (bing.com)

Here we are going to explain some of the beginner stocks that will help to make the right decision to beginners.

• Southern Company (SO): The Southern company’s price target is neutral to $60 with up and down price volatility of 20%. The payout ratio of the company is 100% which means it uses its earnings to pay dividends to the investors.

• The company is a good buy for long-term dividend investors and is likely to grow its dividend in the future.

• V.F Corporation: Though the company has not performed too well in the last years. But it reflects strong growth prospects in the future. The growth of the company will be the result of the focus on new brands, the company's expansion program, and growth through e-commerce.

• The above two are just an example of beginner’s stock. You can get many more from the above link of stockbossup.com.

Start investing in stocks:

To start investing in stocks, you must have a clear answer to the two questions. One is how the stock market works for beginners and the second is how beginners should choose investments.

How stock market work for beginners?

The stock market works for beginners as a marketplace where individual and institutional investors come together to trade and earn profit.

Investing is one of the best ways to multiply your wealth, but there is always a degree of risk involved in investing. As it is not a risk-free investment to trade in stocks, you need to do some thorough research before investing. To start with, you need to evaluate your finances and set specific and clear goals. You need a have a clear picture of how things work in the stock market.

How beginners should choose investment?

It is a very important step to decide which stock you should choose to enter the market as an investor. Here are some of the steps that one must keep in mind before investing in the stock market.

Set clear investment goals: The goals should be in accordance with your finance and should also consider the period you are investing your funds.

Design a well-diversified portfolio: you need to diversify your funds in different sectors to avoid market risk. Specialized financial help can be taken for the same.

Industry research: Thorough research should be carried out on the industry in which you are planning to invest.

Stock evaluation: you need to evaluate your stock before you decide to buy or not to buy a particular stock. SSG is a good technique for stock evaluation.

Preplan your entry and exit: This will help you reap maximum benefits.

SWOT analysis: SWOT stands for Strength, Weakness, Opportunity, and Threat analysis. Before investing you need to understand the core competencies and strengths of the company you are putting your money. This analysis helps in understanding your threats in the form of competitors, substitute products, and also the market structure (Perfect completion, oligopoly, or monopoly) in which the firm is operating.

Value trap: Value trap refers to misleading investments that present lucrative buying opportunities for investors. This attracts you toward an undervalued opportunity. So instead of just relying on the price/earnings ratio one should keep himself updated and stay informed about industry trends and news to avoid getting a value trap.

Images :(bing.com)

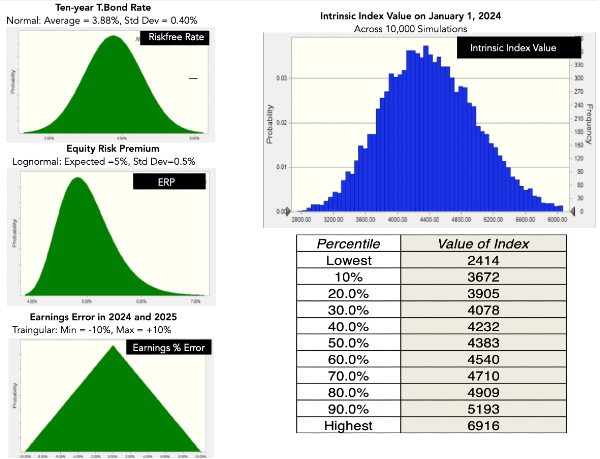

Calculate the intrinsic value: Intrinsic value also known as the real value is the book value per share and can be different from the market value of the share. It is determined by including both tangible and no-tangible factors. As the Intrinsic value is arrived at by proper fundamental analysis, it is more reliable.

By keeping all the above things in mind you can build a strategy to invest and start investing. As it is rightly said:

“Given a 10% chance of a 100 times payoff, you should take that bet every time”.

-Jeff Bezos

Conclusion:

This means you should start investing early and in the right direction with the right plan and with whatever money you have. One should try to reduce the costs by investing in the long term. Invest in companies with strong fundamentals and good P/E ratios. Though there is always a degree of risk involved in investing but you know well that where there is no risk, there is no gain.

https://youtu.be/0k_FZJhszPM

References:

https://www.stockbossup.com/pages/post/12305/a-guide-to-investment-costs-for-beginner-investors

Stock Market Basics - Learn Share Market Basics in India (groww.in)

Basics of the Stock Market for Beginner Investors | The Motley Fool

A Beginners Guide to Stock Investing in 5 easy steps (stockbossup.com)

SWOT Analysis: How To With Table and Example (investopedia.com)

Mastering Competitor Analysis: Key Strategies for Success (blogpilot.ai)

Expertise provided by Darius Smith

Reviewed by Chaster Johnson

When should a beginner buy stocks?

One should start buying/investing in stocks as soon as possible. When it comes to investing in the stock market age does not matter. A student, a youngster, a middle-aged or an old aged person stock market is open for everyone. It is considered to be a very good decision to introduce investment opportunities to students or teenagers at a very early age as this will promote financial literacy and help them understand the basics of the market. Investing as a student: A student can start investing in stocks even at a very early stage of third grade or as soon as he/she starts understanding what is a stock. It means one who is at the age of eight years can easily understand and start trading in their stocks. Investing in the stock market at this early age gives an opportunity to better understand the stock market or we can say it enhances financial literacy.

Best investment for students: The best investment for students is those stocks that you know well. It means if you have an idea of revenue, fundamentals, p/e ratio, prospects, ,etc of the company then it is the best investment for you. Some of the companies are: • McDonalds (MCD): It is a well-known fast-food chain. It gives 2.24% dividends to its shareholders. • General Mills: It is one of the famous staple food producers of America. One can keep this stock in his basket for investment • Tesla (TSLA): Tesla is a vehicle-producing company. It is the best stock if you are thinking of investing for the long-term as it is a volatile stock.

Investing for beginners with little money: Investing is a “commitment of money to receive more money later”. Hence, one should start investing in stocks as soon as possible to get a desirable pattern of cash flows in the future. Huge capital is not needed to commence trading; you can always start with little. As Investing has become very affordable these days you can start off with whatever little capital you have with you. Instead of buying an ETF or whole share, you can opt for buying a piece of a share known as a fractional share. Investing in fractional shares benefits the investor in a number of ways, such as: • It helps in the diversification of your funds as you can buy fractional shares of different companies rather than buying one share of a higher value of one company. • It helps in reducing your beta i.e. market risk. • It provides you with a better understanding of the industry as a whole. • It helps in better portfolio management. • Leads to wealth generation and growth.

Apart from investing in fractional shares as a beginner you also need to take care of the cost part of your investment. Costs have direct impacts on returns on your investment. The two main components of cost in trading are: Commission also termed as transaction cost: It is a cost that is incurred in buying and selling securities. Therefore, to eliminate or reduce this cost you need to reduce the frequency of your trade (Avoiding loss of potential profit occurring from "payment of trade flow"). Tax is another important component of cost that can be reduced by holding your investment for a period of more than one year.

Best stocks for beginners: Fundamentally strong and well-known stocks are always a best choice for beginners to invest in stocks. Before moving to invest in any particular stock you need to learn how the stock market works for beginners. The diagram below explains the procedure to buy the stock.

Image from: Bing.com

how to buy shares of stock - Search Images (bing.com)

Here we are going to explain some of the beginner stocks that will help to make the right decision to beginners. • Southern Company (SO): The Southern company’s price target is neutral to $60 with up and down price volatility of 20%. The payout ratio of the company is 100% which means it uses its earnings to pay dividends to the investors. • The company is a good buy for long-term dividend investors and is likely to grow its dividend in the future. • V.F Corporation: Though the company has not performed too well in the last years. But it reflects strong growth prospects in the future. The growth of the company will be the result of the focus on new brands, the company's expansion program, and growth through e-commerce. • The above two are just an example of beginner’s stock. You can get many more from the above link of stockbossup.com.

Start investing in stocks: To start investing in stocks, you must have a clear answer to the two questions. One is how the stock market works for beginners and the second is how beginners should choose investments. How stock market work for beginners? The stock market works for beginners as a marketplace where individual and institutional investors come together to trade and earn profit. Investing is one of the best ways to multiply your wealth, but there is always a degree of risk involved in investing. As it is not a risk-free investment to trade in stocks, you need to do some thorough research before investing. To start with, you need to evaluate your finances and set specific and clear goals. You need a have a clear picture of how things work in the stock market.

How beginners should choose investment?

It is a very important step to decide which stock you should choose to enter the market as an investor. Here are some of the steps that one must keep in mind before investing in the stock market. Set clear investment goals: The goals should be in accordance with your finance and should also consider the period you are investing your funds. Design a well-diversified portfolio: you need to diversify your funds in different sectors to avoid market risk. Specialized financial help can be taken for the same. Industry research: Thorough research should be carried out on the industry in which you are planning to invest. Stock evaluation: you need to evaluate your stock before you decide to buy or not to buy a particular stock. SSG is a good technique for stock evaluation. Preplan your entry and exit: This will help you reap maximum benefits. SWOT analysis: SWOT stands for Strength, Weakness, Opportunity, and Threat analysis. Before investing you need to understand the core competencies and strengths of the company you are putting your money. This analysis helps in understanding your threats in the form of competitors, substitute products, and also the market structure (Perfect completion, oligopoly, or monopoly) in which the firm is operating. Value trap: Value trap refers to misleading investments that present lucrative buying opportunities for investors. This attracts you toward an undervalued opportunity. So instead of just relying on the price/earnings ratio one should keep himself updated and stay informed about industry trends and news to avoid getting a value trap.

Images :(bing.com) Calculate the intrinsic value: Intrinsic value also known as the real value is the book value per share and can be different from the market value of the share. It is determined by including both tangible and no-tangible factors. As the Intrinsic value is arrived at by proper fundamental analysis, it is more reliable. By keeping all the above things in mind you can build a strategy to invest and start investing. As it is rightly said: “Given a 10% chance of a 100 times payoff, you should take that bet every time”. -Jeff Bezos Conclusion: This means you should start investing early and in the right direction with the right plan and with whatever money you have. One should try to reduce the costs by investing in the long term. Invest in companies with strong fundamentals and good P/E ratios. Though there is always a degree of risk involved in investing but you know well that where there is no risk, there is no gain. https://youtu.be/0k_FZJhszPM

References: https://www.stockbossup.com/pages/post/12305/a-guide-to-investment-costs-for-beginner-investors Stock Market Basics - Learn Share Market Basics in India (groww.in) Basics of the Stock Market for Beginner Investors | The Motley Fool A Beginners Guide to Stock Investing in 5 easy steps (stockbossup.com) SWOT Analysis: How To With Table and Example (investopedia.com) Mastering Competitor Analysis: Key Strategies for Success (blogpilot.ai)