What is Southern Company’s Price Target?

Southern Company’s price target is neutral at $70. Expect the utility’s price volatility to peak at plus or minus 20% from this price target but not improving too far past this price point for the next few years. Southern company’s current payout ratio is effectively 100%, which completely stunts any potential stock growth for the coming years. A payout ratio of 100% means the company uses all of its earnings to pay its dividend. Since Southern company likely doesn’t want to lower its dividend, the company will likely be stagnant for the coming years as they are unable to reinvest in growing the company.

Why is Southern Company Stock Dropping?

Southern Company has an intrinsic value of roughly $60. The stock’s price historically can hover plus or minus 20% from its intrinsic value. This is due to the different needs Southern Company stock fills in the market. Large funds buy up Southern Company to fill out their utility centric ETFs. This pushes demand for the utility. Dividend ETFs also prefer Southern Company for its consistent dividend. These forces push the utility’s stock above its intrinsic value.

On the other side, analysts are very aware of the company’s appropriate value. The company doesn’t have outrageous earning surprises, so analysts have a relatively good grasp on what the stock’s value should be. This force drives the price back to its intrinsic value more consistently, which isn’t normal for all stocks.

This dynamic is why Southern Company’s stock is at risk of falling quickly above the $60 mark. Any negative market news may drive down the stock’s price to reorient it back to its intrinsic value. This phenomenon of Southern Company retracing down to its intrinsic value was seen multiple times in previous years.

The near completion of the Vogle plant has made investors more bullish on the stock. Southern Company went billions of dollars over budget on the Vogle Plant, which is a nuclear plant. The U.S. hasn’t commissioned a new nuclear plant in decades, making this project special.

Investors are rewarding the company for almost finishing the project. The stock’s price has stayed above its estimated intrinsic value since the project’s risks decreased. This bullishness won’t last forever so expect the company’s stock price to dip below the intrinsic value of $60 if any poor economic news develops.

Is Southern Company a Buy?

Southern Company is a great buy for dividend growth investors. Southern Company should be avoided if you are a growth investor.

As we’ll show in our forecast section, price appreciation looks grim for the next couple of years.

Southern Company Forecast

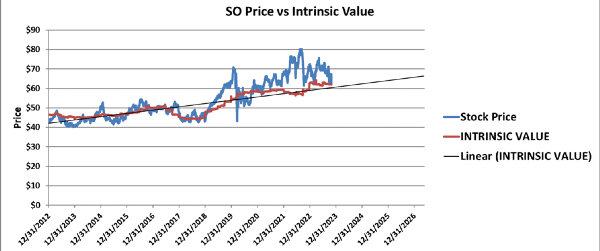

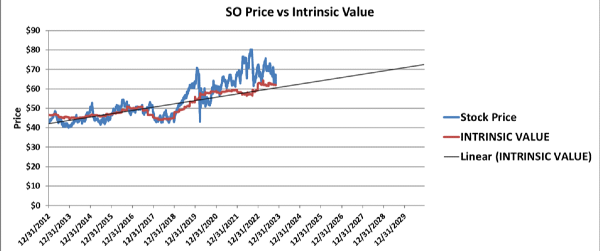

Southern Company intrinsic value versus stock price. Intrinsic value is a predictor of stock price. The linear extrapolation is of the company’s estimated intrinsic value.

Southern Company’s expected growth rate is projected to be linear for the coming years. Growth has been curbed as the business continues to absorb the financial impact of their nuclear power plant construction (Vogtle 3 & 4).

Southern Company Stock Forecast in 2025

Do not expect much price growth from Southern Company for the next two years. The stock price is currently hovering around $70, which is much higher than its estimated intrinsic value of $60.

Southern Company has a historically low growth rate in price, as expected from a utility. Price growth since the 1980’s has followed this trend, and there is no expectation for this trend to change in the coming years.

In 2025, expect southern Company’s stock price to hover around $65. The stock’s price will fluctuate plus or minus $12 from this price but will unlikely collapse or rise beyond this range.

A cut in the utility’s dividend could change the dynamics of this calculation. A payout ratio of effectively 100% is not healthy but also not a death nail for potential dividend growth.

Southern Company Stock Forecast in 2028

By 2028, the utility’s intrinsic value will hopefully get to $70. Right now, Southern Company’s actual price is $70, but it’s intrinsic value will likely not even reach this value until 2028.

By 2028, the utility’s intrinsic value will hopefully get to $70. Right now, Southern Company’s actual price is $70, but it’s intrinsic value will likely not even reach this value until 2028.

The stock price of SO will likely continue to follow its intrinsic value, so any fluctuations back up beyond $80 or $90 may be excessively too high.

What Will Southern Company be at in 2030?

The end of the decade is quite far out, but for Southern Company, some insight may be gained based on the company’s history. Southern Company has continued to grow linearly for over four decades now. The stock is a safe haven for investors during times of uncertainty.

There is nothing in the coming years that looks to really disrupt that growth. Even as the southeast region of the U.S. continue to grow, that is likely already built into Southern Company’s growth projections.

Expect the intrinsic value of Southern Company to be around $75 a share. The stock’s price will likely hover around this price with a plus or minus volatility of $15. If the stock touches $100 per share, it may be a likely time to sell Southern company at any point this decade.

Is Southern Company a Good Buy?

Southern Company is a great long term buy for dividend growth investors. The stock will likely continue to grow its dividend. For long term investors, the price of Southern Company will likely grow consistently and steadily.

If Southern Company faces any downward volatility, it will likely be a great time to buy the utility.

SO Recent News

Recently, it was reported by Reuters that Southern Company increased its estimated budget for the Vogtle reactors. The harsh truth is that this was good news for the company, as the cost increase was only $160 Million. This is significantly lower than previous cost overruns on this project and did not include a push out of the project’s timeline. The completion of this project will help stabilize Southern Company’s earnings.

Southern Company put out an article titled How Southern Company Is Investing in the Future of Energy. The article focuses on the company’s efforts to partner with startups that help with decarbonization. The article is great PR, but the news will likely not affect the company’s price trajectory.

Finally, Georgia Power, a subsidiary of Southern Company, announced on their PR newswire plans to update their integrated resource plan.

This really showcases the growth that is occurring in the southeast as the utility wants to increase their megawatts produced by 6,600 MW through 2030. This projection is up another 400 MW from January 2022 and reflects the continuous growth occurring in Georgia that is exceeding planned expectations.

Southern Company FAQ

Is Southern Company a Dividend King?

Southern company is not a dividend king. A dividend king must consistently increase their dividend yield for fifty years.

Southern company has increased their dividend for the last 22 years, so they are also not yet a dividend aristocrat. A company needs to raise their dividends for 25 years to earn that title.

How Safe is Southern Company Stock?

Southern Company is a very safe stock, but do not expect any exceptional growth from the stock. The stock is safe for long-term investors looking for a consistent dividend.

Southern Company didn’t make our top safest utility stocks due to its poor drawdown. Southern Company had a -38.98% drawdown at some point in the last five years. This wasn’t one of the worst drawdowns in the utility space, but it was poor considering Southern Company is one of the largest utilities in the United States.

I/we have a position in an asset mentioned

What is Southern Company’s Price Target?

Southern Company’s price target is neutral at $70. Expect the utility’s price volatility to peak at plus or minus 20% from this price target but not improving too far past this price point for the next few years. Southern company’s current payout ratio is effectively 100%, which completely stunts any potential stock growth for the coming years. A payout ratio of 100% means the company uses all of its earnings to pay its dividend. Since Southern company likely doesn’t want to lower its dividend, the company will likely be stagnant for the coming years as they are unable to reinvest in growing the company.

Why is Southern Company Stock Dropping?

Southern Company has an intrinsic value of roughly $60. The stock’s price historically can hover plus or minus 20% from its intrinsic value. This is due to the different needs Southern Company stock fills in the market. Large funds buy up Southern Company to fill out their utility centric ETFs. This pushes demand for the utility. Dividend ETFs also prefer Southern Company for its consistent dividend. These forces push the utility’s stock above its intrinsic value.

On the other side, analysts are very aware of the company’s appropriate value. The company doesn’t have outrageous earning surprises, so analysts have a relatively good grasp on what the stock’s value should be. This force drives the price back to its intrinsic value more consistently, which isn’t normal for all stocks.

This dynamic is why Southern Company’s stock is at risk of falling quickly above the $60 mark. Any negative market news may drive down the stock’s price to reorient it back to its intrinsic value. This phenomenon of Southern Company retracing down to its intrinsic value was seen multiple times in previous years.

The near completion of the Vogle plant has made investors more bullish on the stock. Southern Company went billions of dollars over budget on the Vogle Plant, which is a nuclear plant. The U.S. hasn’t commissioned a new nuclear plant in decades, making this project special.

Investors are rewarding the company for almost finishing the project. The stock’s price has stayed above its estimated intrinsic value since the project’s risks decreased. This bullishness won’t last forever so expect the company’s stock price to dip below the intrinsic value of $60 if any poor economic news develops.

Is Southern Company a Buy?

Southern Company is a great buy for dividend growth investors. Southern Company should be avoided if you are a growth investor.

As we’ll show in our forecast section, price appreciation looks grim for the next couple of years.

Southern Company Forecast

Southern Company intrinsic value versus stock price. Intrinsic value is a predictor of stock price. The linear extrapolation is of the company’s estimated intrinsic value.

Southern Company’s expected growth rate is projected to be linear for the coming years. Growth has been curbed as the business continues to absorb the financial impact of their nuclear power plant construction (Vogtle 3 & 4).

Southern Company Stock Forecast in 2025

Do not expect much price growth from Southern Company for the next two years. The stock price is currently hovering around $70, which is much higher than its estimated intrinsic value of $60.

Southern Company has a historically low growth rate in price, as expected from a utility. Price growth since the 1980’s has followed this trend, and there is no expectation for this trend to change in the coming years.

In 2025, expect southern Company’s stock price to hover around $65. The stock’s price will fluctuate plus or minus $12 from this price but will unlikely collapse or rise beyond this range.

A cut in the utility’s dividend could change the dynamics of this calculation. A payout ratio of effectively 100% is not healthy but also not a death nail for potential dividend growth.

Southern Company Stock Forecast in 2028

The stock price of SO will likely continue to follow its intrinsic value, so any fluctuations back up beyond $80 or $90 may be excessively too high.

What Will Southern Company be at in 2030?

The end of the decade is quite far out, but for Southern Company, some insight may be gained based on the company’s history. Southern Company has continued to grow linearly for over four decades now. The stock is a safe haven for investors during times of uncertainty.

There is nothing in the coming years that looks to really disrupt that growth. Even as the southeast region of the U.S. continue to grow, that is likely already built into Southern Company’s growth projections.

Expect the intrinsic value of Southern Company to be around $75 a share. The stock’s price will likely hover around this price with a plus or minus volatility of $15. If the stock touches $100 per share, it may be a likely time to sell Southern company at any point this decade.

Is Southern Company a Good Buy?

Southern Company is a great long term buy for dividend growth investors. The stock will likely continue to grow its dividend. For long term investors, the price of Southern Company will likely grow consistently and steadily.

If Southern Company faces any downward volatility, it will likely be a great time to buy the utility.

SO Recent News

Recently, it was reported by Reuters that Southern Company increased its estimated budget for the Vogtle reactors. The harsh truth is that this was good news for the company, as the cost increase was only $160 Million. This is significantly lower than previous cost overruns on this project and did not include a push out of the project’s timeline. The completion of this project will help stabilize Southern Company’s earnings.

Southern Company put out an article titled How Southern Company Is Investing in the Future of Energy. The article focuses on the company’s efforts to partner with startups that help with decarbonization. The article is great PR, but the news will likely not affect the company’s price trajectory.

Finally, Georgia Power, a subsidiary of Southern Company, announced on their PR newswire plans to update their integrated resource plan.

This really showcases the growth that is occurring in the southeast as the utility wants to increase their megawatts produced by 6,600 MW through 2030. This projection is up another 400 MW from January 2022 and reflects the continuous growth occurring in Georgia that is exceeding planned expectations.

Southern Company FAQ

Is Southern Company a Dividend King?

Southern company is not a dividend king. A dividend king must consistently increase their dividend yield for fifty years.

Southern company has increased their dividend for the last 22 years, so they are also not yet a dividend aristocrat. A company needs to raise their dividends for 25 years to earn that title.

How Safe is Southern Company Stock?

Southern Company is a very safe stock, but do not expect any exceptional growth from the stock. The stock is safe for long-term investors looking for a consistent dividend.

Southern Company didn’t make our top safest utility stocks due to its poor drawdown. Southern Company had a -38.98% drawdown at some point in the last five years. This wasn’t one of the worst drawdowns in the utility space, but it was poor considering Southern Company is one of the largest utilities in the United States.

I/we have a position in an asset mentioned