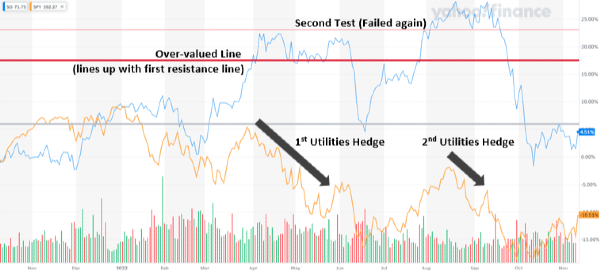

As per my research, I recommend a sell rating for Exelon Corporation (EXC). At today's price of $42.63, the utility stock looks to be 5% overvalued from its estimated intrinsic value of $40.15. The key concerns are:

- Since the business is split off and a new business is established separately is this one of the reasons.

- EXC Over-Valued at $44.17

- EXC Fair-Value Estimate: $40.15

- EXC Under-Valued at $36.14

On the closure of Wednesday, December 21st, 2022, the price of Exelon Corporation stock increased by 1%, moving from $42.17 to $42.59. It has now gained four straight days. It will be interesting to see whether it can gain more over the next few days or if it decides to take a small break. The stock's price changed by 1.09% during the most recent trading day, moving from a day low of $42.20 to a day high of $42.66. The price has increased in six of the last ten days and over the last two weeks, it has increased by 0.72%. On the last day, volume decreased by -1 million shares, and 3 million shares were bought and sold for a total transaction value of roughly $134.07 million. You should be aware that divergence is caused by declining volume on higher prices and may serve as a major contributor to changes that could occur over the next few days.

Exelon Corporation (EXC) Price Forecast

- 2024 Price Forecast: $41.86

- 2026 Price Forecast: $43.33

If they can resolve their business-related issues, Exelon Corporation (EXC) can experience strong price growth. With a focus on nuclear power generation, Exelon Corporation recently separated Constellation Energy. The price of Exelon Corporation could rise over the following five years if it can resolve issues with its deteriorating margins and aging fleet of power generation.

Read more: Top Utility Stocks

What is EXC Valuation?

As of Q4 2022, Exelon Corporation has the following key metrics:

- Earnings Per Share: $2.06

- Book Value per Share: $24.74

- Earnings Growth (YoY): Volatile

Exelon Corporation is expected to open at $42.48 on Thursday, December 22, 2022, and move throughout the day (based on a 14-day average true range) between $41.63 and $43.54, giving a possible trading interval of +/-$0.95 (+/-2.24%) up or down from the previous closing price. The difference between the day's lowest and highest trading prices is predicted to be 4.48% if Exelon Corporation uses the entire calculated possible swing range.

Read More: 5 Gym Stocks to Check Out, AMC Stock Forecast

EBITDA vs. Earnings Per Share

EBITDA serves as a substitute for other metrics like revenue, earnings, or net income when assessing a company's financial performance. Earnings per share are referred to as EPS. Essentially, it represents the amount of net income that was earned by a company's shareholders at the end of a time frame (quarterly or yearly).

Exelon's EBITDA quarterly and annually from 2010 to 2022. Earnings before interest, taxes, depreciation and amortization are known as EBITDA.

- Exelon's EBITDA was $1.836 billion for the three months ending September 30, 2022, a 33.96% year-over-year decrease.

- Exelon's EBITDA was $7.216 billion for the fiscal year that ended on September 30, 2022, a 32.82% decrease from the previous year.

- EBITDA for Exelon in 2021 was $10.296 billion, up 10.12% from 2020.

- Exelon's annual EBITDA for 2020 was $9.35 billion, down 7.92% from 2019.

- Exelon's annual EBITDA for 2019 was $10.154 billion, up 2.96% from 2018.

From 2010 to 2022, Exelon's annual and quarterly earnings per share were recorded. Earnings per share is the sum of a company's net profits or losses attributable to common shareholders divided by the total number of diluted shares, which includes all debt, options, and warrants.

- Exelon's earnings per share for the three months ending September 30, 2022, were $0.68, a 44.72% year-over-year decline.

- Exelon's EPS for the fiscal year that ended on September 30, 2022, was $2.16, up 26.32% from the previous year.

- The annual EPS for Exelon in 2021 was $1.74, a 13.43% decrease from 2020.

- Exelon's annual EPS for 2020 was $2.01, down 33.22% from 2019.

- Exelon's annual EPS for 2019 was $3.01, up 45.41% from 2018.

Exelon Corporation Stock Forecast, Risk & Stop-loss

The stock's downside is supported by accumulated volume at $37.76 and $37.71, which are just below the current price. When a stock is testing a support level, there is a risk that it will break that level, which could cause the stock to fall to the next support level. Exelon Corporation finds support in this instance at $37.76, which is just below the current price. The next support levels from the volume that has built up are $37.71 and $36.96 if this is broken.

The risk is viewed as a medium for this stock due to its daily average movement and high trading volume. The stock moved $0.460, or 1.09%, between the high and low over the previous day. The stock's daily average volatility over the previous week was 1.89%.

$41.01 (-3.71%) is the stop-loss amount we advise. The risk associated with this stock's medium daily movements is medium. An earlier-than-five-day-old pivot top has generated a sell signal.

Recommendation

We conclude that the current level may present a buying opportunity as there is a reasonable chance that the stock of Exelon Corporation will perform well in the short term in light of several positive short-term signals and a generally positive trend. However, in the long-run selling is the better option as per our research.

Read More: Nvidia Stock Price & Forecast

As per my research, I recommend a sell rating for Exelon Corporation (EXC). At today's price of $42.63, the utility stock looks to be 5% overvalued from its estimated intrinsic value of $40.15. The key concerns are:

On the closure of Wednesday, December 21st, 2022, the price of Exelon Corporation stock increased by 1%, moving from $42.17 to $42.59. It has now gained four straight days. It will be interesting to see whether it can gain more over the next few days or if it decides to take a small break. The stock's price changed by 1.09% during the most recent trading day, moving from a day low of $42.20 to a day high of $42.66. The price has increased in six of the last ten days and over the last two weeks, it has increased by 0.72%. On the last day, volume decreased by -1 million shares, and 3 million shares were bought and sold for a total transaction value of roughly $134.07 million. You should be aware that divergence is caused by declining volume on higher prices and may serve as a major contributor to changes that could occur over the next few days.

Exelon Corporation (EXC) Price Forecast

If they can resolve their business-related issues, Exelon Corporation (EXC) can experience strong price growth. With a focus on nuclear power generation, Exelon Corporation recently separated Constellation Energy. The price of Exelon Corporation could rise over the following five years if it can resolve issues with its deteriorating margins and aging fleet of power generation.

Read more: Top Utility Stocks

What is EXC Valuation?

As of Q4 2022, Exelon Corporation has the following key metrics:

Exelon Corporation is expected to open at $42.48 on Thursday, December 22, 2022, and move throughout the day (based on a 14-day average true range) between $41.63 and $43.54, giving a possible trading interval of +/-$0.95 (+/-2.24%) up or down from the previous closing price. The difference between the day's lowest and highest trading prices is predicted to be 4.48% if Exelon Corporation uses the entire calculated possible swing range.

Read More: 5 Gym Stocks to Check Out, AMC Stock Forecast

EBITDA vs. Earnings Per Share

EBITDA serves as a substitute for other metrics like revenue, earnings, or net income when assessing a company's financial performance. Earnings per share are referred to as EPS. Essentially, it represents the amount of net income that was earned by a company's shareholders at the end of a time frame (quarterly or yearly).

Exelon's EBITDA quarterly and annually from 2010 to 2022. Earnings before interest, taxes, depreciation and amortization are known as EBITDA.

From 2010 to 2022, Exelon's annual and quarterly earnings per share were recorded. Earnings per share is the sum of a company's net profits or losses attributable to common shareholders divided by the total number of diluted shares, which includes all debt, options, and warrants.

Exelon Corporation Stock Forecast, Risk & Stop-loss

The stock's downside is supported by accumulated volume at $37.76 and $37.71, which are just below the current price. When a stock is testing a support level, there is a risk that it will break that level, which could cause the stock to fall to the next support level. Exelon Corporation finds support in this instance at $37.76, which is just below the current price. The next support levels from the volume that has built up are $37.71 and $36.96 if this is broken.

The risk is viewed as a medium for this stock due to its daily average movement and high trading volume. The stock moved $0.460, or 1.09%, between the high and low over the previous day. The stock's daily average volatility over the previous week was 1.89%.

$41.01 (-3.71%) is the stop-loss amount we advise. The risk associated with this stock's medium daily movements is medium. An earlier-than-five-day-old pivot top has generated a sell signal.

Recommendation

We conclude that the current level may present a buying opportunity as there is a reasonable chance that the stock of Exelon Corporation will perform well in the short term in light of several positive short-term signals and a generally positive trend. However, in the long-run selling is the better option as per our research.

Read More: Nvidia Stock Price & Forecast