The Top Industrial Stocks

The Best Industrial Stocks

Industrial stocks are a broad category of companies. They manufacture and distribute goods. They are a vital part of the global economy, and they can be a good investment for long-term investors. However, there are so many different industrial stocks to choose from. It can be difficult to know which ones are the best. In this article, we will discuss some of the best industrial stocks for 2023. We will give tips on picking the best industrial stocks for your portfolio.

Are Industrials a Good Investment?

Industrials can be a good investment for several reasons. These stocks are typically cyclical. Their performance is linked to the overall health of the economy. When the economy is doing well, industrials tend to outperform the market. However, when the economy is in a downturn, industrials can underperform. Industrials often pay dividends. This can give investors a steady stream of income. Industrials can also be a good hedge against inflation. This is because their products and services tend to get more expensive over time. Industrials have risks. They are cyclical stocks, so their performance can be volatile. The industrial sector has risks too. These risks are changes in government policy, trade wars, and commodity prices.

Great Industrial ETFs

If you want to invest in industrials but you're not sure which stocks to buy, you can invest in an industrial ETF. Industrial ETFs are a group of industrial stocks that trade on a stock exchange. They have advantages over individual stocks. For example, they offer diversification, lower fees, and easier trading.

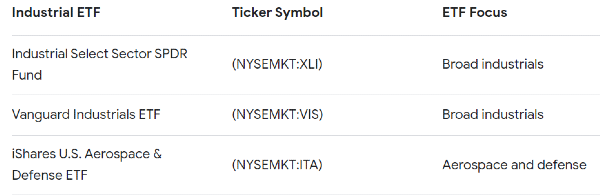

Here are a few of the best industrial ETFs for 2023:

- The SPDR S&P Industrial Select Sector ETF (XLI) tracks the S&P Industrial Select Sector Index. It is an index of 60 of the largest and most liquid industrial stocks in the United States.

- iShares U.S. Industrials ETF (IYJ) tracks the Dow Jones U.S. Industrials Index. The index includes 30 of the largest industrial stocks in the United States.

- Vanguard Industrials Index Fund ETF (VIS) tracks the CRSP US Industrials Index. The index includes 247 industrial stocks in the United States.

What is the Manufacturing Sector?

The manufacturing sector forms the backbone of many industries. It plays a crucial role in transforming raw materials into the finished goods we rely on daily. It includes a wide range of activities. People craft intricate electronics. They process food and forge steel.

Here's a concise breakdown:

The core function is to convert raw materials into finished products. These raw materials include metals, wood, and chemicals. This is done through physical or chemical processes.

Examples: Automobiles, aeroplanes, machinery, furniture, clothing, food products, pharmaceuticals, medical devices, and more.

It is a significant contributor to global GDP. It employs millions of people and drives innovation across various industries.

Subsectors are diverse. They include heavy manufacturing, such as steel and shipbuilding. Light manufacturing, such as electronics and clothing, is another. There's also food and beverage. There's aerospace and defense. There are also chemicals and pharmaceuticals.

Key Attributes:

Manufacturing adds value. It creates finished products from raw materials. These products are more useful and functional.

Scale and Automation: It often involves large-scale production. It also often involves increasing automation. This is for efficiency and cost-effectiveness.

Supply chains integrate complex networks of suppliers, manufacturers, and distributors. They bring products to market.

Innovation means always creating new technologies and processes. We do this to make things work better, make products better, and take care of the environment.

The manufacturing sector will continue to change in the future. This change is due to automation, digitalization, and sustainability concerns. Embracing these trends is essential for its growth. It will also help the company adapt to the global market.

This overview gives a basic understanding of manufacturing. You can focus on specific details like globalization or challenges. It depends on your audience and how complex you want it.

Great Industrial Stocks with Dividends

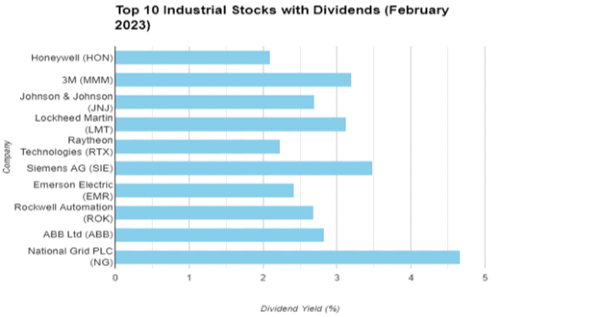

Industrial stocks can provide a strong mix of dividend income. They also have the potential for capital growth. They are often well-established companies. They have proven track records. They are exposed to growing sectors. These include infrastructure, automation, and clean energy. Here are some outstanding industrial stocks with dividends. They are categorized by subsector. Consider them for your portfolio.

Defense & Aerospace:

Lockheed Martin (LMT) is a stalwart in the defense industry. LMT boasts a 3.13% dividend yield and consistent dividend growth. The company has a strong track record. They have delivered F-35 fighter jets and other advanced technologies. This predicts future income stability.

Raytheon Technologies (RTX) has a 2.23% dividend yield. It is a diversified defense giant. It benefits from exposure to fighter jets, missiles, and hypersonic. Their focus on innovation suggests they will continue to grow dividends. Their growing order backlog also suggests this.

Automation & Robotics:

Honeywell International (HON) is a leader in industrial automation. It is also a leader in building controls. HON offers a 2.10% dividend yield. It has a history of steady increases. They have a diverse product portfolio. Being committed to R&D, they make a solid choice for generating income.

ABB Ltd (ABB) is a global leader in robotics and automation. It pays a dividend yield of 2.83%. ABB is committed to sustainable solutions. They are also committed to digitalization. This positions them for future growth. It also sets them up for potential dividend hikes.

Clean Energy & Infrastructure:

Siemens AG (SIE): A European clean energy leader, SIE offers a 3.48% dividend yield. They focus on wind turbines, smart grids, and building technologies. This aligns with growing sustainability trends and suggests reliable dividend income.

ational Grid PLC (NG): A UK-based electricity and gas transmission operator. It boasts a 4.66% dividend yield. Their regulated business model provides stability for income investors. They also focus on infrastructure upgrades.

Industrial Automation & Software:

Emerson Electric (EMR) is an automation solutions provider for various industries. It offers a 2.42% dividend yield. They have a strong presence in oil & gas and refining. This promises potential for both income and growth. Their expansion into renewables also shows promise.

Rockwell Automation (ROK) is a leader in industrial automation software. ROK provides a 2.69% dividend yield. They focus on smart factories and connected industries. This positions them well for future growth. This could also lead to higher dividends.

Beyond Dividends: Evaluating for Long-Term Success

While dividend yield is important, remember it's just one piece of the puzzle. Consider these factors for a holistic evaluation:

Look for companies with strong balance sheets and low debt. Also, look for consistent profitability. This will ensure sustainable dividend payments.

Analyze the company's position in growing markets. Evaluate their commitment to innovation and overall business strategy. This will help gauge the potential for capital appreciation alongside dividend income.

Check the stock price to make sure it matches the company's value and prospects. This helps avoid overpaying.

Remember, diversification is key. Consider spreading your investments across different subsectors within the industrial space. This will help mitigate risk and capture diverse growth opportunities.

Important Manufacturing Sector Ratios

Several important ratios can be used to evaluate industrial stocks. These ratios can help investors to assess the financial health and profitability of a company. Here are a few of the most important manufacturing sector ratios:

The P/E ratio is a measure of a company's stock price relative to its earnings per share. A lower P/E ratio can indicate that a stock is undervalued.

Price-to-book ratio (P/B ratio): The P/B ratio is a measure of a company's stock price relative to its book value per share. A lower P/B ratio can indicate that a stock is undervalued.

Debt-to-equity ratio (D/E ratio): The D/E ratio is a measure of a company's debt relative to its equity. A lower D/E ratio indicates that a company is less leveraged and more financially stable.

Why Invest in Manufacturing Stocks?

Investing in manufacturing stocks can offer several potential benefits. It's important to be informed. Weigh both the pros and cons before making investment decisions. Here's a breakdown of some key points to consider:

Reasons to Invest in Manufacturing Stocks:

1. Steady Growth: Factories make things people need in daily life, from phones to medicine. This steady demand can lead to stable growth for well-run companies. It could mean more money for investors over time.

2. Dividends: Manufacturing companies give dividends to investors. Dividends are regular payments for owning the stock. This can provide a nice income stream alongside potential stock price growth.

3. Real-World Impact: When you invest in manufacturing, you support companies that make and sell things we use daily. This can feel good, knowing you're contributing to the economy and creating jobs.

4. Diversification: You can reduce risk by adding manufacturing stocks to your portfolio. This spreads your risk across different industries. This can help protect your investments if one sector performs poorly.

5. Innovation: Manufacturing companies always search for new ways to improve. These advancements can lead to breakthroughs that increase stock prices.

Things to Remember:

Not all manufacturing companies are the same: Some might be growing quickly, while others might be facing challenges. Do your research to choose strong companies with good management.

Manufacturing can be cyclical: Sometimes demand for goods goes up and down, which can affect stock prices. Be prepared for potential ups and downs.

Risks are involved: Like any investment, manufacturing stocks come with risks. There's always a chance the company won't do well, and you could lose money.

Overall, investing in manufacturing stocks can potentially grow your wealth. It can also support essential industries. However, it's crucial to do your research. Understand the risks. Choose only companies you believe in.

What Affects the Industrial Sector?

Many things can affect the industrial sector. It's like a giant workshop making all sorts of cool things. Just like your day at school, different events can affect it. Here are some key things that can impact the industrial world:

1. Demand for Stuff

Imagine if everyone suddenly wanted new bikes! Factories producing bikes would be bustling, needing more workers and materials. That's how demand works. When people and businesses want more stuff, like cars, furniture, or medicine, the industrial sector gets busy making it. This creates jobs and growth.

2. Cost of Making Stuff

Just like buying ingredients for a cake, factories need materials and energy to make things. If the cost of these things, like metal for cars or oil for energy, goes up, it can become more expensive to produce goods. This affects profits and sometimes prices.

3. Technology

Remember those old, clunky phones? Technology keeps changing and improving, and the industrial sector needs to adapt. New machines, robots, and software can help factories work faster, cheaper, and better. However, they can also require workers to learn new skills.

4. Trade

Countries often trade goods they make with each other. If trade gets easier by removing barriers or signing agreements, factories can sell their products more widely. This boosts the sector. But if trade becomes difficult, companies might sell less, impacting jobs and growth.

5. Government Rules

Sometimes governments create rules to protect the environment, safety, or workers. These can affect how factories operate and sometimes add costs. However, they're important for a healthy and sustainable industry.

6. Global Events

Pandemics or wars can disrupt supply chains. This makes it harder to get materials or ship finished goods. This can cause temporary slowdowns in the industrial sector until things stabilize again.

Remember, the industrial sector is complex. Its success depends on many factors working together. These factors create jobs, build cool things, and contribute to a healthy economy!

The Best Industrial Stocks for the Long Term

Focusing on Specific Subsectors:

Broad industrial ETFs offer diversification. However, digging deeper into subsectors can unlock targeted opportunities. Here are some promising areas within the industrial sector:

The global defense landscape remains volatile. It drives demand for fighter jets, satellites, and other military equipment. Consider Lockheed Martin (LMT), Raytheon Technologies (RTX), and Boeing (BA).

Automation and robotics are on the rise in manufacturing and logistics. This presents compelling investment opportunities. Explore Honeywell International (HON), ABB Ltd (ABB), and Rockwell Automation (ROK).

Clean Energy & Infrastructure: Sustainability efforts and infrastructure upgrades fuel growth in renewable energy. They also fuel growth in electric vehicles and smart grids. Look into Siemens AG (SIE), Schneider Electric (SU), and First Solar (FSLR).

Industrial firms rely on software and digital solutions to optimize operations. They use these tools for industrial automation. Target Emerson Electric (EMR), Honeywell International (HON), and PTC (PTC).

Beyond the Numbers: Considering Qualitative Factors:

While financial ratios are crucial, don't overlook qualitative factors like:

- A strong, innovative culture and visionary leadership can drive long-term success.

- Companies that continuously invest in R&D are better equipped to adapt to future trends.

- Understanding the competitive landscape and a company's market share helps gauge its sustainability. It shows how well the company can keep going.

- Investors consider a company's commitment to sustainability and responsible practices. This is part of the Environmental, Social, & Governance (ESG) Commitment.

Investing Wisely: Your Personalized Approach:

Investing in industrial stocks can help you earn more money in the long run. You can also get money from dividends. If you learn about the industry, different parts of it, and specific companies, you can make smart decisions. This helps you align with your investment objectives. Stay informed about economic trends. Stay informed about company performance and emerging technologies. Doing so will help you navigate the dynamic industrial landscape.

It is similar to planting a tree. You need to do research and choose carefully. Over time, the stocks can grow and provide income (shade). They can also offer capital appreciation (fruit). Industrial stocks are similar to trees. They need patience and understanding. The industry has many different subsectors. Some examples are manufacturing giants and clean energy innovators. Each subsector has its own risks and rewards. It is important to research and choose companies that align with your investment goals and risk tolerance.

The industrial landscape changes constantly. It's influenced by economic trends, company performance, and new technologies. Stay informed and adjust your strategy. That way, you can navigate these changes. You might succeed with your industrial stock portfolio.

Top Industrial Stocks: The Complete Guide for 2026

If you’re searching for the top consumer discretionary stocks, this guide gives you a clearer picture than traditional rankings based on market cap or last year’s earnings. Instead of backward‑looking metrics, our list is powered by the real‑world performance of StockBossUp’s highest‑achieving investors. These investors must consistently perform well to stay ranked, which adds accountability and depth to every stock they choose.

This means the stocks you see here aren’t just popular. They reflect conviction backed by results. If you want to compete with top investors and share your own ideas, join StockBossUp and make your mark.

The Top 5 Industrial Stocks

These five companies represent the top Industrial stocks chosen by our highest‑performing community members. The list updates daily, giving you a real‑time look at where experienced investors see opportunity in this stock category.

There may be less than 5 stocks when top investors are not rating Industrial a buy.

Why These Stocks Stand Out

Each stock earns its place through:

Strong long‑term investor sentiment

Consistent performance from top‑ranked users

Analysis focused on durable growth, not short‑term hype

The Top 16 Industrial Stocks

This expanded list gives you a broader view of the best Industrial consumer discretionary stocks for long‑term investors. These stocks are ranked by sentiment from our highest‑performing long‑term investors, offering a snapshot of where experienced stock pickers see opportunity today.