The Top Utilities Investing in Clean, Renewable Energy

Clean energy and renewable energy aren’t interchangeable. For our analysis, we focused on wind energy and solar energy. These two sources are clean, renewable, and sustainable energy sources. Natural gas and nuclear power are also important factors in sustainable energy; however, it’s debatable how clean these energy sources are. Geothermal energy is also added to list; however, in the U.S. its current usage is limited.

Curious about utility-scale Solar? Check out our article on the top utilities investing in solar

Below are the top utilities investing in renewable energy. Total wind power is labeled as MW (MegaWatts), which is a measure of energy a power plant can generate per unit of time. A megawatt of capacity can produce enough energy for 400 to 900 homes a year. Each utility uses a diversified fleet of power plants to meet their customers’ electricity demands. The percentage of that utility's fleet which is wind power is in parenthesis.

1). NextEra Energy (NEE) – 23,072 MW (40.7%)

2). The Southern Company (SO) – 4,928 MW (11.2%)

3). Duke Energy Corporation (DUK) – 3,300 MW (6.6%)

4). Exelon (EXC) – 2,942 MW (8.8%)

5). Dominion Energy (D) – 2,212 MW (8.2%)

6). American Electric Power (AEP) – 1,376 MW (5.3%)

The Utility with the Most Renewable Energy

NextEra Energy (NEE) has the largest fleet of wind and solar power generation, making up nearly 40% of its total portfolio. If you want to get into renewable energy regardless of the company’s valuation, NextEra Energy is the investment for you.

However, there is a possibility, as of Q1 2023, that NextEra Energy is overvalued. The reason for this potential over-valuation is unknown, but theories include:

- ETFs are over buying ESG stocks

- The market in general pays a premium for renewable energy stocks

If you’re unsure if a utility stock is valued correctly, check out our guide to value utilities. You can also evaluate utility stocks using the stock selection guide.

Southern Company, Renewable Energy, and its valuation

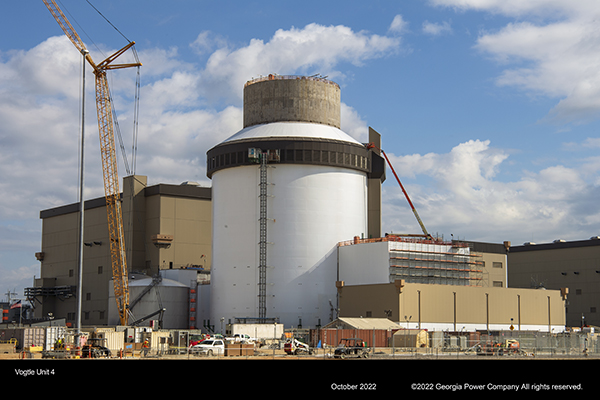

Southern Company has invested heavily in wind and solar power, with nearly 11% of its fleet in these sustainable energy sources. Southern Company is also set to open a nuclear power plant, named Plant Vogtle, in the U.S. A nuclear power plant hasn’t been built in the U.S. in the last 30 years. Plant Vogtle has added risk to Southern Company’s portfolio, but after countless budget overruns and delays, management plans on opening the plant in 2023.

Southern Company looks to be fairly valued at today’s price of $68. This means that investors should be cautious about investing in Southern Company.

Read More: How Southern Company was evaluated. Check out our calculations for Southern Company here

Duke Energy, Sustainable Power, Energy Market Exposure

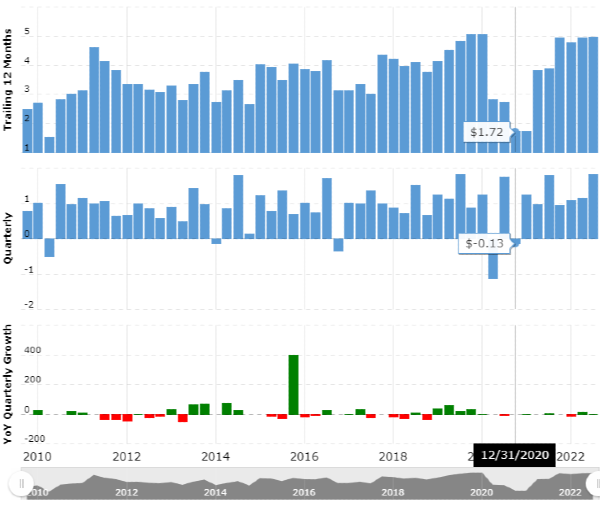

Duke Energy is a great all-around utility. The utility is trending towards sustainable power generation, even though its fleet still has a lot of coal and oil plants. Duke Energy is currently under-valued based on our guide to evaluating utilities; however, its EPS growth has been volatile over the last few months.

Source: macrotrends.net. Earnings fell dramatically in 2020 and 2021.

That said, Duke Energy has been a top stock in multiple categories.

Duke Energy may be a consistent, undervalued, and safe utility investment if you’re looking for an income investment opportunity. Note that its swings in EPS may be due to the company’s exposure to natural gas through its natural gas distribution division. This exposure could cause future price volatility; however, historically, Duke Energy has proven they can keep price volatility low.

Exelon Corporation (EXC)

Exelon Corporation is one of the top utility stocks investing in renewable energy. As of Q1 2023, its fairly-valued at a price of $41.69.

Exelon’s wind energy spans 29 wind projects across 10 states

Dominion Energy, a Fallen Dividend King

As noted in our article on the safest utility stocks to invest in, Dominion Energy got a dishonorable mention because they cut their dividend in Q4 2020. You can learn more about Dominion Energy here:

American Electric Power, Committed to Renewable Energy

AEP is dedicated to transforming their power generation fleet to renewable energy. They have increased their hydro, wind, and solar by 49% and cut down their coal capacity by 47%. AEP may potentially be a buying opportunity as it may be potentially undervalued at a current price of $93.07.

Frequently Asked Questions

Below we answer some questions frequently asked about renewable energy and utility investing.

Which Utility has the Most Renewable Energy

NextEra Energy by far has the most renewable energy with 40.7% of their fleet in wind and solar energy.

What are Green Energy Utilities

Green energy refers to sources that are sustainable and have a low impact on the natural environment. Fossil fuels are finite resources that also negatively impact the environment due to pollution, smog, and global warning. Nuclear energy outputs nuclear waste, which can contaminate the environment significantly with radiation poisoning if not safely contained and separated. Hydropower is a sustainable energy source; however, it affects ecosystems by disrupting rivers.

Wind and solar energy are the biggest sources of green energy. They makeup significant portions of some power generation fleets and don’t have significant known impacts on the environment. A green energy utility has a proven track record of converting to green energy and has laid out a plan to provide the bulk of their customer’s electric needs with green energy within the next 20 years.

Utilities like NextEra Energy have almost half of their power generation coming from green energy sources, while American Electric Power has a proven track record of building green energy sources and has a plan to convert its fleet in the next decades.

Why Don’t Utilities Switch to Renewable Energy?

Utilities are switching to renewable energy. Utilities are driven to switch because of the high and volatile prices of fossil fuels along with government incentives to build renewable energy.

One of the biggest barriers to using wind and solar energy was the inconsistency of harvesting energy from these resources. Solar cannot harvest power at night and wind turbines don’t spin if there is no wind.

But new battery storage technology allows the electric infrastructure to store excess energy when wind and solar is plentiful, and release energy into the grid as necessary. These batteries can smooth out supply issues with renewable energy.

Utilities are making a systematic change to their power generation fleets across the board. Nearly every major U.S. utility is investing in renewable energy. The largest utilities, like NextEra Energy, have roughly 40% of their fleet in wind and solar energy. Companies like AEP have already converted large portions of their fleet and are committed to continue this conversion thru the next decade.

Read More: The Top Utilities Investing in Wind Energy

The Bottom Line

Utility stocks have committed to renewable energy. The business case to convert to renewable energy continues to improve as fossil fuels continue to be volatile and expensive.

Even though these stocks are great as renewable energy plays, there is a risk that some may be overvalued. Some stocks, like Dominion Energy, have decreased their dividend recently.

Be sure to do your own, detailed research before investing in renewable energy. You can’t support renewable energy with an investment if you’re losing money in the stock market.

I/we have a position in an asset mentioned

Cover Image by Andreas from Pixabay

The Top Utilities Investing in Clean, Renewable Energy

Clean energy and renewable energy aren’t interchangeable. For our analysis, we focused on wind energy and solar energy. These two sources are clean, renewable, and sustainable energy sources. Natural gas and nuclear power are also important factors in sustainable energy; however, it’s debatable how clean these energy sources are. Geothermal energy is also added to list; however, in the U.S. its current usage is limited.

Below are the top utilities investing in renewable energy. Total wind power is labeled as MW (MegaWatts), which is a measure of energy a power plant can generate per unit of time. A megawatt of capacity can produce enough energy for 400 to 900 homes a year. Each utility uses a diversified fleet of power plants to meet their customers’ electricity demands. The percentage of that utility's fleet which is wind power is in parenthesis.

1). NextEra Energy (NEE) – 23,072 MW (40.7%)

2). The Southern Company (SO) – 4,928 MW (11.2%)

3). Duke Energy Corporation (DUK) – 3,300 MW (6.6%)

4). Exelon (EXC) – 2,942 MW (8.8%)

5). Dominion Energy (D) – 2,212 MW (8.2%)

6). American Electric Power (AEP) – 1,376 MW (5.3%)

The Utility with the Most Renewable Energy

NextEra Energy (NEE) has the largest fleet of wind and solar power generation, making up nearly 40% of its total portfolio. If you want to get into renewable energy regardless of the company’s valuation, NextEra Energy is the investment for you. However, there is a possibility, as of Q1 2023, that NextEra Energy is overvalued. The reason for this potential over-valuation is unknown, but theories include:

If you’re unsure if a utility stock is valued correctly, check out our guide to value utilities. You can also evaluate utility stocks using the stock selection guide.

Source: Georgia Southern Webpage

Southern Company, Renewable Energy, and its valuation

Southern Company has invested heavily in wind and solar power, with nearly 11% of its fleet in these sustainable energy sources. Southern Company is also set to open a nuclear power plant, named Plant Vogtle, in the U.S. A nuclear power plant hasn’t been built in the U.S. in the last 30 years. Plant Vogtle has added risk to Southern Company’s portfolio, but after countless budget overruns and delays, management plans on opening the plant in 2023. Southern Company looks to be fairly valued at today’s price of $68. This means that investors should be cautious about investing in Southern Company.

Duke Energy, Sustainable Power, Energy Market Exposure

Duke Energy is a great all-around utility. The utility is trending towards sustainable power generation, even though its fleet still has a lot of coal and oil plants. Duke Energy is currently under-valued based on our guide to evaluating utilities; however, its EPS growth has been volatile over the last few months.

Source: macrotrends.net. Earnings fell dramatically in 2020 and 2021.

That said, Duke Energy has been a top stock in multiple categories.

Duke Energy was ranked the 3rd safest utility stock in terms of dividend consistency and price volatility

Duke Energy has a dividend policy consistent with other top utility stocks

Duke Energy was ranked the 3rd best electric utility stock

Duke Energy may be a consistent, undervalued, and safe utility investment if you’re looking for an income investment opportunity. Note that its swings in EPS may be due to the company’s exposure to natural gas through its natural gas distribution division. This exposure could cause future price volatility; however, historically, Duke Energy has proven they can keep price volatility low.

Exelon Corporation (EXC)

Exelon Corporation is one of the top utility stocks investing in renewable energy. As of Q1 2023, its fairly-valued at a price of $41.69.

Exelon’s wind energy spans 29 wind projects across 10 states

Dominion Energy, a Fallen Dividend King

As noted in our article on the safest utility stocks to invest in, Dominion Energy got a dishonorable mention because they cut their dividend in Q4 2020. You can learn more about Dominion Energy here:

Dominion Stock Forecast – Dominion Stock Dividend

Why is Dominion Energy Stock Dropping? Is It Still Safe to Invest?

American Electric Power, Committed to Renewable Energy

AEP is dedicated to transforming their power generation fleet to renewable energy. They have increased their hydro, wind, and solar by 49% and cut down their coal capacity by 47%. AEP may potentially be a buying opportunity as it may be potentially undervalued at a current price of $93.07.

Frequently Asked Questions

Below we answer some questions frequently asked about renewable energy and utility investing.

Which Utility has the Most Renewable Energy

NextEra Energy by far has the most renewable energy with 40.7% of their fleet in wind and solar energy.

What are Green Energy Utilities

Green energy refers to sources that are sustainable and have a low impact on the natural environment. Fossil fuels are finite resources that also negatively impact the environment due to pollution, smog, and global warning. Nuclear energy outputs nuclear waste, which can contaminate the environment significantly with radiation poisoning if not safely contained and separated. Hydropower is a sustainable energy source; however, it affects ecosystems by disrupting rivers.

Wind and solar energy are the biggest sources of green energy. They makeup significant portions of some power generation fleets and don’t have significant known impacts on the environment. A green energy utility has a proven track record of converting to green energy and has laid out a plan to provide the bulk of their customer’s electric needs with green energy within the next 20 years.

Utilities like NextEra Energy have almost half of their power generation coming from green energy sources, while American Electric Power has a proven track record of building green energy sources and has a plan to convert its fleet in the next decades.

Why Don’t Utilities Switch to Renewable Energy?

Utilities are switching to renewable energy. Utilities are driven to switch because of the high and volatile prices of fossil fuels along with government incentives to build renewable energy.

One of the biggest barriers to using wind and solar energy was the inconsistency of harvesting energy from these resources. Solar cannot harvest power at night and wind turbines don’t spin if there is no wind.

But new battery storage technology allows the electric infrastructure to store excess energy when wind and solar is plentiful, and release energy into the grid as necessary. These batteries can smooth out supply issues with renewable energy.

Utilities are making a systematic change to their power generation fleets across the board. Nearly every major U.S. utility is investing in renewable energy. The largest utilities, like NextEra Energy, have roughly 40% of their fleet in wind and solar energy. Companies like AEP have already converted large portions of their fleet and are committed to continue this conversion thru the next decade.

The Bottom Line

Utility stocks have committed to renewable energy. The business case to convert to renewable energy continues to improve as fossil fuels continue to be volatile and expensive.

Even though these stocks are great as renewable energy plays, there is a risk that some may be overvalued. Some stocks, like Dominion Energy, have decreased their dividend recently.

Be sure to do your own, detailed research before investing in renewable energy. You can’t support renewable energy with an investment if you’re losing money in the stock market.

I/we have a position in an asset mentioned