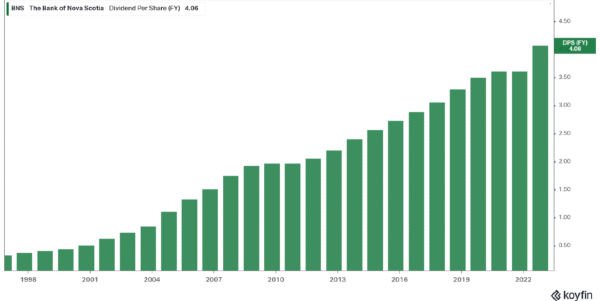

Dividend Safety Analysis: Franklin Resources (BEN). The firm is a Dividend Aristocrat and Dividend Champion with 42 years of increases, which makes it interesting to dividend growth investors. The dividend has been raised continuously since 1981. The stock also has a forward dividend yield of about 3.55%, making it interesting for investors seeking income.

However, the firm’s erratic revenue and earnings history since 2014 has caused investor to shy away from the stock. Despite fee compression and intense competition from index funds, the company has remained profitable. This fact, combined with Franklin Resources (BEN) solid dividend yield and excellent dividend safety metrics, makes this stock of interest.

Franklin Resources Overview

Franklin Resource is a global asset manager providing services to individuals, institutions, pension plans, trusts, and partnerships. Its funds are marketed under the Franklin, Templeton, Brandywine, Western Asset Management, Clarion, Martin Currie, and Royce brands.

At the end of Q4 fiscal year 2022, it had $1.4 trillion assets under management (AUM). Of this about 37% fixed income, 30% equity, 19% alternative, 10% multi-asset, and 5% cash. Approximately 72% of AUM is in US funds, with the rest in international funds.

Total revenue was $8,275 million in fiscal year 2022 and $8,018 million in the past twelve months.

Franklin Resources Revenue and Earnings Growth

Franklin Resources has struggled with revenue and earnings growth since the fiscal year 2014. In fact, according to Portfolio Insight*, companywide revenue, operating income, and net income declined from 2014 to 2019. It only reversed in 2020 because of market action and the Legg Mason acquisition.

In addition, gross margins, operating margins, and net profit margins have trended down since 2015 since cost cuts and efficiency gains did not keep up with the decline in revenue and operating income. However, this downward trend of margins was recently reversed due to the addition of Legg Mason’s assets. That said, they are still volatile.

Passive Index Fund Are Popular

Active asset managers, such as Franklin Resources, are facing significant industrywide headwinds resulting from the rise of passive investing. Increasingly, retail and institutional investors are migrating to index funds or ETFs due to their very low costs and ubiquity. Fund costs are a penalty on investor returns. From this perspective, index funds have an advantage. They track the benchmark index, so costs and thus expense ratios are minimal. In addition, there is seemingly an index fund for almost any basket of stocks. So, investors can get exposure to large areas of the market with little expense.

Some active asset managers have bucked this trend, but Franklin Resources is not one. The company’s AUM has declined or, at best, remained flat year to year between 2014 and 2019. The AUM is impacted by market action, net flows, and foreign exchange. The problem for Franklin Resources is persistent net outflows despite market appreciation.

The firm has moved to an acquisition strategy to add to its AUM.

Fee Compression

Furthermore, the industry faces industrywide fee compression, particularly for equity funds. This fact has also contributed to lower revenue. Some industry watchers feel there is a race to zero, like stock commissions. Today, some index mutual funds have a zero expense ratio. However, zero fund fees are still not the most popular funds.

Fund Performance

Until recently, the problem has been compounded by relatively poor fund performance. However, most of Franklin Templeton’s funds are now outperforming its peers and benchmarks.

Fund performance has both a direct and indirect effect on revenue. First, a well performing fund will rise in net asset value (NAV), resulting in higher AUM. Next, good fund performance attracts retail and institutional investors. Ultimately, good fund performance will drive gains in AUM.

Growth by Acquisition

By acquisitions, Franklin Resources has decided to address its AUM, revenue, and margin challenges. In the asset management business, scale matters for operational efficiencies. For instance, it takes little in the way of additional cost for a fund to scale from $1 billion to $2 billion. The fixed costs are stable, and the variable costs increase only incrementally.Along these lines, Franklin Resources bought Legg Mason in 2020, significantly boosting its AUM. In addition, the firm acquired O’Shaughnessy Asset Management in 2021 with about $6.9 billion in AUM. In addition, it acquired Lexington Partners, an alternate investment firm, in 2022. This acquisition added another $35 billion to AUM. The BNY Alcentra acquisition adde to its alternative category.

Franklin Resources is buying smaller firms in a consolidating industry. Beside Legg Mason, Franklin Resources has acquired AdvisorEngine, Benefit Street Partners, Capstead Mortgage, O’Shaughnessy Asset Management, Lexington Partners, and BNY Alcentra in the past two years.

Franklin Resources (BEN) Dividend Safety

Franklin Resources (BEN) has excellent dividend safety metrics from the view of earnings, free cash flow (FCF), and the balance sheet. The forward dividend yield is now around 3.55%. This value is more than twice the average dividend yield of the S&P 500 Index.

From the perspective of earnings, the dividend is decently covered. Consensus FY 2023 earnings per share are $2.36, and the annual dividend is $1.20 per share, giving a payout ratio of ~38.1%. This percentage is a good value and well below our target value of 65%.

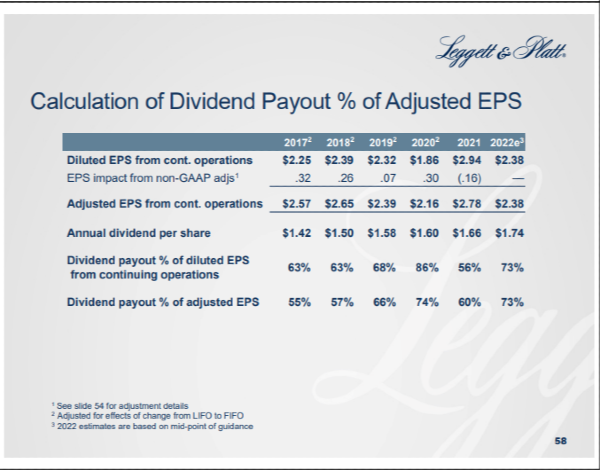

Payout Ratio

The trend is for the payout ratio to increase for Franklin Resources. According to Portfolio Insight*, the payout ratio was below ~20% for many years and only went over that value in 2017 and has trended up since then to more than 40%. However, the small recent dividend increases combined with the earnings boost from the Legg Mason and other acquisitions caused the non-GAAP payout ratio to decline. The most recent increase was to $0.30 from $0.29 per share.

The dividend is well covered by FCF. In fiscal 2022, operating cash flow was $1,956.7 million, and capital expenditures were $90.3 million giving FCF of $1,866.4 million. The dividend required $583.1 million, resulting in a dividend-to-FCF ratio of roughly 31%. This value is conservative and below our threshold value of 70%.

Significantly, Franklin Resources’ use of cash flow has improved, and it is no longer buying back excessive amounts of shares. Instead, the current focus are acquisitions and shareholder return.

Debt

Debt is a bright spot since the company has a net cash position. At the end of Q1 FY 2023, Franklin Resources had $3,547.8 million in cash and cash equivalents on its balance sheet. There was zero short-term or current long-term debt, and long-term debt was around $3,370.5 million.

In addition, the firm had about $2,045.8 million in long-term investments. Interest coverage is more than 12.7X and the leverage ratio is 0.15X. Additionally, the credit rating agencies give the firm an A / A2 upper-medium investment-grade credit rating. As a result, there is little risk to Franklin Resources’ (BEN) dividend and safety from debt.

Franklin Resources’ Valuation

The market has punished Franklin Resource’s stock price, which is down substantially from the all-time high set in 2014 and is now trading at ~$33.698 (as of this writing). However, Franklin Resources remains profitable despite the challenges and still pays a solid dividend yield with excellent dividend safety metrics.

Franklins Resources is trading at a depressed valuation of ~14.3X forward earnings. This price-to-earnings (P/E) ratio is much lower than the S&P 500’s average of ~22.1X. Additionally, the current valuation is lower within the range in the past decade, but more than the span in the trailing 5-years. However, the reason for this point, is revenue and margin declines have persisted for several years. The stock is probably fairly valued, but the stock price has trended up from its recent lows during the pandemic.

Final Thoughts on Franklin Resources (BEN) Dividend Safety

Franklin Resources’ yield is attractive, and at approximately 3.55%, it far exceeds that of the broader market. It is also higher than many of the income stocks. But Franklin Resources is facing industrywide headwinds that are negatively affecting AUM and thus revenue and margins. The firm is following a growth by acquisitions strategy that has stabilized and even turned around revenue, AUM, and margin declines. For investors seeking income, the dividend safety of Franklin Resources is acceptable.

You can also read Dividend Safety Analysis: Apple (AAPL).

Related Articles on Dividend Power

Dividend Safety Analysis: Franklin Resources (BEN). The firm is a Dividend Aristocrat and Dividend Champion with 42 years of increases, which makes it interesting to dividend growth investors. The dividend has been raised continuously since 1981. The stock also has a forward dividend yield of about 3.55%, making it interesting for investors seeking income.

However, the firm’s erratic revenue and earnings history since 2014 has caused investor to shy away from the stock. Despite fee compression and intense competition from index funds, the company has remained profitable. This fact, combined with Franklin Resources (BEN) solid dividend yield and excellent dividend safety metrics, makes this stock of interest.

Franklin Resources Overview

Franklin Resource is a global asset manager providing services to individuals, institutions, pension plans, trusts, and partnerships. Its funds are marketed under the Franklin, Templeton, Brandywine, Western Asset Management, Clarion, Martin Currie, and Royce brands.

At the end of Q4 fiscal year 2022, it had $1.4 trillion assets under management (AUM). Of this about 37% fixed income, 30% equity, 19% alternative, 10% multi-asset, and 5% cash. Approximately 72% of AUM is in US funds, with the rest in international funds.

Total revenue was $8,275 million in fiscal year 2022 and $8,018 million in the past twelve months.

Franklin Resources Revenue and Earnings Growth

Franklin Resources has struggled with revenue and earnings growth since the fiscal year 2014. In fact, according to Portfolio Insight*, companywide revenue, operating income, and net income declined from 2014 to 2019. It only reversed in 2020 because of market action and the Legg Mason acquisition.

Source: Portfolio Insight*

In addition, gross margins, operating margins, and net profit margins have trended down since 2015 since cost cuts and efficiency gains did not keep up with the decline in revenue and operating income. However, this downward trend of margins was recently reversed due to the addition of Legg Mason’s assets. That said, they are still volatile.

Passive Index Fund Are Popular

Active asset managers, such as Franklin Resources, are facing significant industrywide headwinds resulting from the rise of passive investing. Increasingly, retail and institutional investors are migrating to index funds or ETFs due to their very low costs and ubiquity. Fund costs are a penalty on investor returns. From this perspective, index funds have an advantage. They track the benchmark index, so costs and thus expense ratios are minimal. In addition, there is seemingly an index fund for almost any basket of stocks. So, investors can get exposure to large areas of the market with little expense.

Some active asset managers have bucked this trend, but Franklin Resources is not one. The company’s AUM has declined or, at best, remained flat year to year between 2014 and 2019. The AUM is impacted by market action, net flows, and foreign exchange. The problem for Franklin Resources is persistent net outflows despite market appreciation.

The firm has moved to an acquisition strategy to add to its AUM.

Fee Compression

Furthermore, the industry faces industrywide fee compression, particularly for equity funds. This fact has also contributed to lower revenue. Some industry watchers feel there is a race to zero, like stock commissions. Today, some index mutual funds have a zero expense ratio. However, zero fund fees are still not the most popular funds.

Fund Performance

Until recently, the problem has been compounded by relatively poor fund performance. However, most of Franklin Templeton’s funds are now outperforming its peers and benchmarks.

Fund performance has both a direct and indirect effect on revenue. First, a well performing fund will rise in net asset value (NAV), resulting in higher AUM. Next, good fund performance attracts retail and institutional investors. Ultimately, good fund performance will drive gains in AUM.

Growth by Acquisition

By acquisitions, Franklin Resources has decided to address its AUM, revenue, and margin challenges. In the asset management business, scale matters for operational efficiencies. For instance, it takes little in the way of additional cost for a fund to scale from $1 billion to $2 billion. The fixed costs are stable, and the variable costs increase only incrementally.Along these lines, Franklin Resources bought Legg Mason in 2020, significantly boosting its AUM. In addition, the firm acquired O’Shaughnessy Asset Management in 2021 with about $6.9 billion in AUM. In addition, it acquired Lexington Partners, an alternate investment firm, in 2022. This acquisition added another $35 billion to AUM. The BNY Alcentra acquisition adde to its alternative category.

Franklin Resources is buying smaller firms in a consolidating industry. Beside Legg Mason, Franklin Resources has acquired AdvisorEngine, Benefit Street Partners, Capstead Mortgage, O’Shaughnessy Asset Management, Lexington Partners, and BNY Alcentra in the past two years.

Franklin Resources (BEN) Dividend Safety

Franklin Resources (BEN) has excellent dividend safety metrics from the view of earnings, free cash flow (FCF), and the balance sheet. The forward dividend yield is now around 3.55%. This value is more than twice the average dividend yield of the S&P 500 Index.

From the perspective of earnings, the dividend is decently covered. Consensus FY 2023 earnings per share are $2.36, and the annual dividend is $1.20 per share, giving a payout ratio of ~38.1%. This percentage is a good value and well below our target value of 65%.

Payout Ratio

The trend is for the payout ratio to increase for Franklin Resources. According to Portfolio Insight*, the payout ratio was below ~20% for many years and only went over that value in 2017 and has trended up since then to more than 40%. However, the small recent dividend increases combined with the earnings boost from the Legg Mason and other acquisitions caused the non-GAAP payout ratio to decline. The most recent increase was to $0.30 from $0.29 per share.

Source: Portfolio Insight*

The dividend is well covered by FCF. In fiscal 2022, operating cash flow was $1,956.7 million, and capital expenditures were $90.3 million giving FCF of $1,866.4 million. The dividend required $583.1 million, resulting in a dividend-to-FCF ratio of roughly 31%. This value is conservative and below our threshold value of 70%.

Significantly, Franklin Resources’ use of cash flow has improved, and it is no longer buying back excessive amounts of shares. Instead, the current focus are acquisitions and shareholder return.

Debt

Debt is a bright spot since the company has a net cash position. At the end of Q1 FY 2023, Franklin Resources had $3,547.8 million in cash and cash equivalents on its balance sheet. There was zero short-term or current long-term debt, and long-term debt was around $3,370.5 million.

In addition, the firm had about $2,045.8 million in long-term investments. Interest coverage is more than 12.7X and the leverage ratio is 0.15X. Additionally, the credit rating agencies give the firm an A / A2 upper-medium investment-grade credit rating. As a result, there is little risk to Franklin Resources’ (BEN) dividend and safety from debt.

Franklin Resources’ Valuation

The market has punished Franklin Resource’s stock price, which is down substantially from the all-time high set in 2014 and is now trading at ~$33.698 (as of this writing). However, Franklin Resources remains profitable despite the challenges and still pays a solid dividend yield with excellent dividend safety metrics.

Franklins Resources is trading at a depressed valuation of ~14.3X forward earnings. This price-to-earnings (P/E) ratio is much lower than the S&P 500’s average of ~22.1X. Additionally, the current valuation is lower within the range in the past decade, but more than the span in the trailing 5-years. However, the reason for this point, is revenue and margin declines have persisted for several years. The stock is probably fairly valued, but the stock price has trended up from its recent lows during the pandemic.

Final Thoughts on Franklin Resources (BEN) Dividend Safety

Franklin Resources’ yield is attractive, and at approximately 3.55%, it far exceeds that of the broader market. It is also higher than many of the income stocks. But Franklin Resources is facing industrywide headwinds that are negatively affecting AUM and thus revenue and margins. The firm is following a growth by acquisitions strategy that has stabilized and even turned around revenue, AUM, and margin declines. For investors seeking income, the dividend safety of Franklin Resources is acceptable.

You can also read Dividend Safety Analysis: Apple (AAPL).

Related Articles on Dividend Power

Originally Posted in Dividend Power