Is BorgWarner a Buy or Sell?

BorgWarner fell below $30 today, making it an interesting buy opportunity. The reasons are quite straightforward. The company’s book value per share is $25.36 a share. This means that as long as money continues to be made, BorgWarner becomes undervalued if it nears its book value per share.

BorgWarner’s EPS forecast for 2024 is a low of $3.56 to $3.88. That means that the company expects to improve from it’s 2023 abysmal $2.70 EPS. If you discount these earnings over the next 10 years and add it to the book value per share, you easily get a price that exceeds $50 per share. So why is the market undervaluing the company?

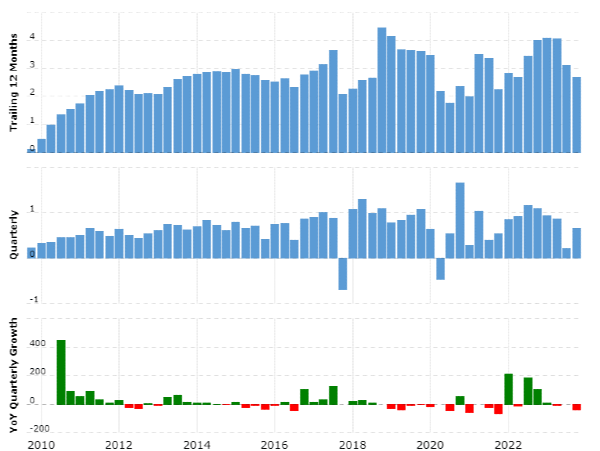

BorgWarner’s earnings are effectively stagnant. The company hasn’t grown its earnings in the last decade with eps effectively flat for a decade.

This has become the losing story for BorgWarner. They are a great company, but they do not have the growth necessary to attract more capital. They are nearly completely owned by institutional investors, and these funds are not interested in further investment until some kind of growth can be shown in the earnings. That said, the company has become deeply undervalued against a backdrop of refocus for the company.

BorgWarner is going Electric

BorgWarner is shaking up their businesses and realigning their core business on cars and electricity. The company’s re-alignment started in 2021 and looks to increase the company’s share in hybrid and electric vehicles. This change is lowering the amount of work the company is conducting in combustion engine markets.

BorgWarner (BWA) is undertaking a significant realignment towards electric propulsion. Here are some key aspects of their strategy:

Project Charging Forward

Project Charging Forward was announced in Q1 2021. The main goal is to move the company’s revenue share in electric vehicles to 45% by 2030. The plan contains three components:

1). Scaling profitability of electric light vehicles.

2). Expansion into electric commercial vehicles.

3). Cutting weaker combustion businesses from the portfolio.

While making this transformation, the company will work to keep its double-digit margin performance. For the most recent quarter, the results of this goal have been mixed. While return on equity was at 10.34%, operating margin was only at 8.46%.

The company needs to raise its profit margin if it wants to meet its margin performance goal.

The company is also looking to generate $4.5 Billion in free cash flow between 2021 and 2025. In 2023, the company generated $1.4 billion in operating cash flow, well within the yearly goal they are targeting for this initiative.

The Risks to BorgWarner’s Strategy Charging Forward

BorgWarner’s realignment towards electric propulsion, while promising, does come with several risks:

1). Technological Challenges: The shift to electric vehicles (EVs) involves significant technological changes. If BorgWarner is unable to keep up with the rapid pace of innovation in this field, it could impact their competitive position.

2). Market Acceptance: The success of BorgWarner’s strategy heavily depends on the market acceptance of EVs. If the adoption of EVs is slower than expected, it could affect the company’s projected growth.

3). Regulatory Risks: Changes in regulations related to emissions and fuel economy standards could impact the demand for EVs and, consequently, BorgWarner’s products.

4). Competition: The EV market is highly competitive. Established automakers and new entrants are all vying for a share of the EV market. Increased competition could lead to price pressures, reduced margins, and loss of market share.

5). Supply Chain Risks: The production of EV components requires specific raw materials, such as lithium and cobalt, which are subject to price volatility and availability issues. Any disruptions in the supply chain could impact production and profitability.

6). Financial Risks: The significant investments required for the transition to electric propulsion could strain BorgWarner’s financial resources. If the returns on these investments are lower than expected, it could impact the company’s financial health.

These risks highlight the need for careful planning, strategic investments, and agile execution in BorgWarner’s transition to electric propulsion. It’s important to note that while these risks are significant, they are not insurmountable. With the right strategies, BorgWarner can mitigate these risks and successfully navigate its transition to electric propulsion.

BorgWarner is Seeing Healthy Revenue Growth

BorgWarner has proven that they can grow revenue through organic growth and acquisitions. The company has had positive revenue growth for most of the 2020s.

The company’s stock price is stagnant thanks to poor operating margins. As the company transitions, they need to be protect their margins.

BorgWarner Book Value Growing, but Goodwill a Risk

BWA book value per share has grown nearly every year. The biggest chunk removed was likely due to the recent spin-off of Phinia Inc (PHIN). That spin-off gave shareholders of BWA shares of the new company, meaning the company lost book value, but this didn’t sacrifice shareholder value.

Goodwill stands at about $3.5 billion. This isn’t a large part of the company’s book value, but its large enough to watch carefully. As the company’s acquisitions mature, these values should start to fall as the company depreciates the goodwill. Hopefully, its replaced with increased assets in other categories like cash, lower debt, and other tangible assets.

BorgWarner (BWA) Stock Forecast

BorgWarner has the potential to grow exponentially in the coming years if the company can deeply penetrate the electric component market for vehicles. The growth could be even larger if EV adoption expands faster.

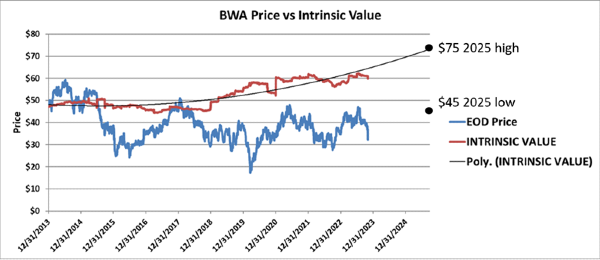

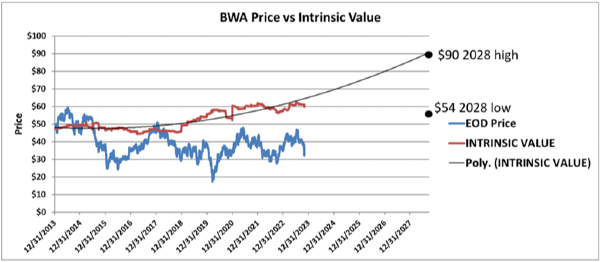

The market has been skeptical of BorgWarner. This has translated into a stock price that has stayed below the company’s intrinsic value. Analyzing BorgWarner’s price movements for the last decade, BWA has previously jumped 20% to 40% when it’s below its intrinsic value by 40%.

When setting a price range for the remainder of the 2020’s, our model assumes second order polynomial growth out for the next 5 years. We also set a significant 40% risk factor into the model, which duplicates the discount the market has placed on BorgWarner since 2017.

BWA 2-Year Price Forecast into 2025

Our price target for BWA by 2025 is a low of $45 and a high of $75. With how volatile the stock is, this entire price range may be hit in the next two years. It is doubtful that the market will reward BWA by pushing its price past the intrinsic value. This is due to the market’s souring on BWA’s risky bet into the EV market. And the market isn’t crazy to be skeptical about this plan. BorgWarner has to see a wild upswing in EV use and secure itself as the top sub-tier supplier for EV components.

However, the negativity forgets what BorgWarner already has. The company is a solid, decades old, manufacturing company that continues to produce a significant number of electrical components for combustion engine cars. The company will continue to be a major player in the electric component market for the next decade.

BWA 5-Year Price Forecast into 2028

Using the same analysis, we could see BWA reach a high of $90 per share by 2028 and a low of $54. For all the concerns we have about BorgWarner, the fact that revenue and book value continue to rise exponentially is a sign that the business is healthy and will continue to add to shareholder value.

At the same time, BWA has proven to be very volatile. The stock’s beta is 1.31 which means its movements to market are exaggerated by about 31% on average. Hence, it would be a surprise if BWA’s stock price didn’t move significantly in 2025 and 2028. It would be a surprise if the company’s stock didn’t trade in the complete price range we predict.

Conclusion

BorgWarner (BWA) is a potential buy as the stock has fallen near its intrinsic value. After spinning off Phinia (PHIN), the company should be able to focus on its core mission of dominating the electrical car component market.

Due to BWA’s wide price swings, our price targets for 2025 are $45 to $75 and for 2028 the price range is $54 to $90.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days

Is BorgWarner a Buy or Sell?

BorgWarner fell below $30 today, making it an interesting buy opportunity. The reasons are quite straightforward. The company’s book value per share is $25.36 a share. This means that as long as money continues to be made, BorgWarner becomes undervalued if it nears its book value per share.

BorgWarner’s EPS forecast for 2024 is a low of $3.56 to $3.88. That means that the company expects to improve from it’s 2023 abysmal $2.70 EPS. If you discount these earnings over the next 10 years and add it to the book value per share, you easily get a price that exceeds $50 per share. So why is the market undervaluing the company?

BorgWarner’s earnings are effectively stagnant. The company hasn’t grown its earnings in the last decade with eps effectively flat for a decade.

BWA Historical EPS from macrotrends.net

This has become the losing story for BorgWarner. They are a great company, but they do not have the growth necessary to attract more capital. They are nearly completely owned by institutional investors, and these funds are not interested in further investment until some kind of growth can be shown in the earnings. That said, the company has become deeply undervalued against a backdrop of refocus for the company.

BorgWarner is going Electric

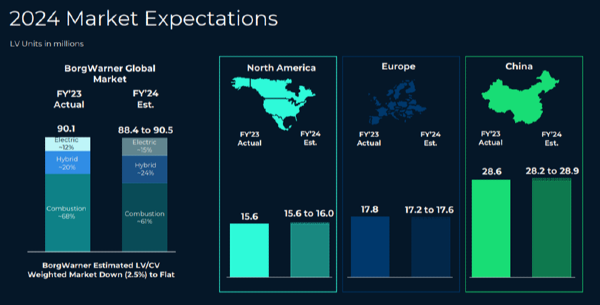

BorgWarner is shaking up their businesses and realigning their core business on cars and electricity. The company’s re-alignment started in 2021 and looks to increase the company’s share in hybrid and electric vehicles. This change is lowering the amount of work the company is conducting in combustion engine markets.

BorgWarner Q1 2024 investor presentation, page 23

BorgWarner (BWA) is undertaking a significant realignment towards electric propulsion. Here are some key aspects of their strategy:

Project Charging Forward

Project Charging Forward was announced in Q1 2021. The main goal is to move the company’s revenue share in electric vehicles to 45% by 2030. The plan contains three components:

1). Scaling profitability of electric light vehicles. 2). Expansion into electric commercial vehicles. 3). Cutting weaker combustion businesses from the portfolio.

While making this transformation, the company will work to keep its double-digit margin performance. For the most recent quarter, the results of this goal have been mixed. While return on equity was at 10.34%, operating margin was only at 8.46%.

The company needs to raise its profit margin if it wants to meet its margin performance goal.

The company is also looking to generate $4.5 Billion in free cash flow between 2021 and 2025. In 2023, the company generated $1.4 billion in operating cash flow, well within the yearly goal they are targeting for this initiative.

The Risks to BorgWarner’s Strategy Charging Forward

BorgWarner’s realignment towards electric propulsion, while promising, does come with several risks:

1). Technological Challenges: The shift to electric vehicles (EVs) involves significant technological changes. If BorgWarner is unable to keep up with the rapid pace of innovation in this field, it could impact their competitive position. 2). Market Acceptance: The success of BorgWarner’s strategy heavily depends on the market acceptance of EVs. If the adoption of EVs is slower than expected, it could affect the company’s projected growth. 3). Regulatory Risks: Changes in regulations related to emissions and fuel economy standards could impact the demand for EVs and, consequently, BorgWarner’s products. 4). Competition: The EV market is highly competitive. Established automakers and new entrants are all vying for a share of the EV market. Increased competition could lead to price pressures, reduced margins, and loss of market share. 5). Supply Chain Risks: The production of EV components requires specific raw materials, such as lithium and cobalt, which are subject to price volatility and availability issues. Any disruptions in the supply chain could impact production and profitability. 6). Financial Risks: The significant investments required for the transition to electric propulsion could strain BorgWarner’s financial resources. If the returns on these investments are lower than expected, it could impact the company’s financial health.

These risks highlight the need for careful planning, strategic investments, and agile execution in BorgWarner’s transition to electric propulsion. It’s important to note that while these risks are significant, they are not insurmountable. With the right strategies, BorgWarner can mitigate these risks and successfully navigate its transition to electric propulsion.

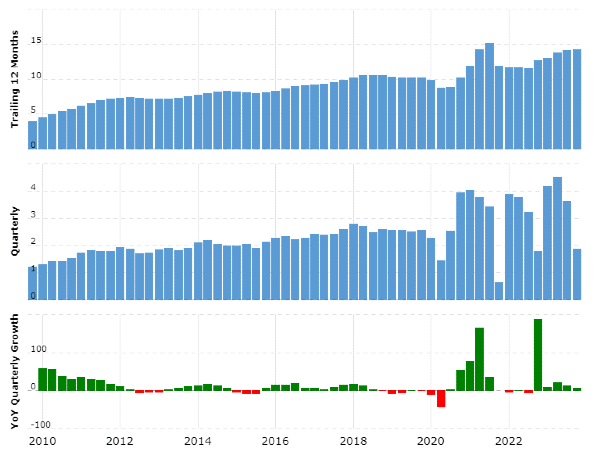

BorgWarner is Seeing Healthy Revenue Growth

Data from macrotrends.net

BorgWarner has proven that they can grow revenue through organic growth and acquisitions. The company has had positive revenue growth for most of the 2020s.

The company’s stock price is stagnant thanks to poor operating margins. As the company transitions, they need to be protect their margins.

BorgWarner Book Value Growing, but Goodwill a Risk

BWA book value per share has grown nearly every year. The biggest chunk removed was likely due to the recent spin-off of Phinia Inc (PHIN). That spin-off gave shareholders of BWA shares of the new company, meaning the company lost book value, but this didn’t sacrifice shareholder value.

Goodwill stands at about $3.5 billion. This isn’t a large part of the company’s book value, but its large enough to watch carefully. As the company’s acquisitions mature, these values should start to fall as the company depreciates the goodwill. Hopefully, its replaced with increased assets in other categories like cash, lower debt, and other tangible assets.

BorgWarner (BWA) Stock Forecast

BorgWarner has the potential to grow exponentially in the coming years if the company can deeply penetrate the electric component market for vehicles. The growth could be even larger if EV adoption expands faster.

The market has been skeptical of BorgWarner. This has translated into a stock price that has stayed below the company’s intrinsic value. Analyzing BorgWarner’s price movements for the last decade, BWA has previously jumped 20% to 40% when it’s below its intrinsic value by 40%.

When setting a price range for the remainder of the 2020’s, our model assumes second order polynomial growth out for the next 5 years. We also set a significant 40% risk factor into the model, which duplicates the discount the market has placed on BorgWarner since 2017.

BWA 2-Year Price Forecast into 2025

Our price target for BWA by 2025 is a low of $45 and a high of $75. With how volatile the stock is, this entire price range may be hit in the next two years. It is doubtful that the market will reward BWA by pushing its price past the intrinsic value. This is due to the market’s souring on BWA’s risky bet into the EV market. And the market isn’t crazy to be skeptical about this plan. BorgWarner has to see a wild upswing in EV use and secure itself as the top sub-tier supplier for EV components. However, the negativity forgets what BorgWarner already has. The company is a solid, decades old, manufacturing company that continues to produce a significant number of electrical components for combustion engine cars. The company will continue to be a major player in the electric component market for the next decade.

BWA 5-Year Price Forecast into 2028

Using the same analysis, we could see BWA reach a high of $90 per share by 2028 and a low of $54. For all the concerns we have about BorgWarner, the fact that revenue and book value continue to rise exponentially is a sign that the business is healthy and will continue to add to shareholder value.

At the same time, BWA has proven to be very volatile. The stock’s beta is 1.31 which means its movements to market are exaggerated by about 31% on average. Hence, it would be a surprise if BWA’s stock price didn’t move significantly in 2025 and 2028. It would be a surprise if the company’s stock didn’t trade in the complete price range we predict.

Conclusion

BorgWarner (BWA) is a potential buy as the stock has fallen near its intrinsic value. After spinning off Phinia (PHIN), the company should be able to focus on its core mission of dominating the electrical car component market.

Due to BWA’s wide price swings, our price targets for 2025 are $45 to $75 and for 2028 the price range is $54 to $90.

I/we have no positions in any asset mentioned, but may initiate a position over the next 7 days